Stock market crash? The data will tell you whether you should get into a panic about a higher rate

December 13 2021

| Tags: accelerate the completion of tapering, hawkish statement, ongoing inflation concern

On November 30, Powell, President of FED, made an unexpected hawkish statement at the quarterly hearing of Senate Banking Committee, indicating that they will discuss whether to accelerate the completion of tapering at the FOMC meeting in December due to the ongoing inflation concern. Affected by this, the market rate hike expectation rose sharply, and U.S. stocks, gold, U.S. bond prices fell significantly that day.

On December 1, multiple banks published the new rate hike expectation. Bank of America predicted that FED will raise the rate 3 times (75 base points) in 2022, 4 times (100 base points) in 2023 and once in 2024. Barclays predicted that FED will raise the rate 3 times in 2022, with the first rate hike coming in May, and 4 more rate hikes in 2023. The market plunged again due to the panic that day.

Actually in 2021, the market was affected by the rate hike expectation several times already. Mr. Powell could only reassure investors every time that ending the bond purchase program is not equal to rate hike; and there will be no rate hike before the employment reaches the standard and American economy is fully recovered. Why does the market regard rate hikes as a monster? Will rate hikes really make the U.S. stock market collapse? Let's have a look at the analysts' conclusions based on historical data.

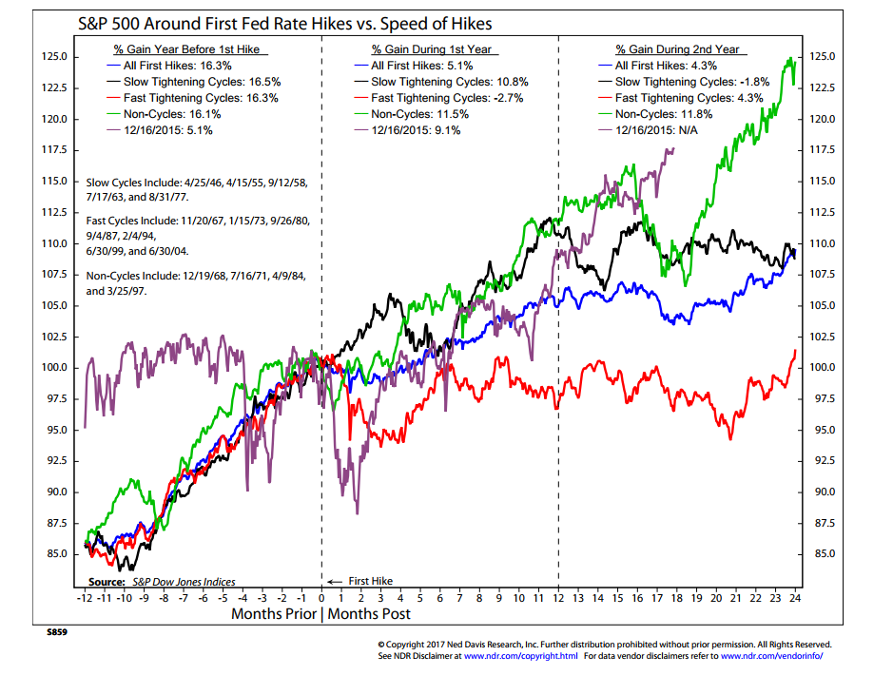

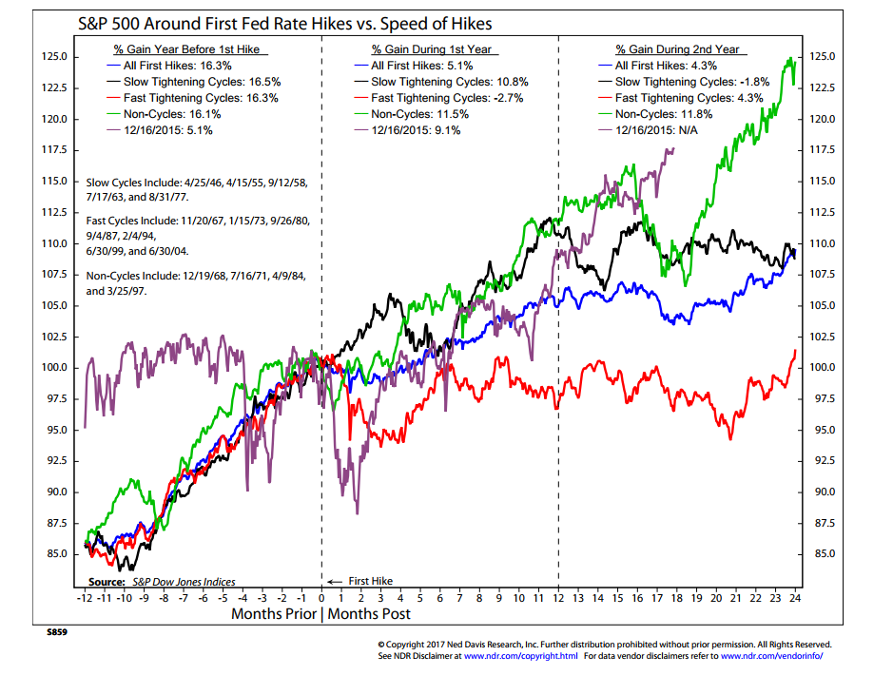

The above chart shows a study of Ned David Research Inc. made in 2017 about market trends in all years of rate hikes in the history. They plotted the S&P 500 trends and rates of return from the 12 months before, the 12 months during, and the 12 months after rate hikes.

As we can see, in the year before the rate hike, the return of S&P was about 16%, no matter whether the rate hike cycle was steep or flat or there was no obvious cycle. In the year of rate hike, the S&P could still have a return of about 11% if FED kept in full communication with the market and mastered the appropriate pace of the hikes. If the pace of hikes was too steep, the S&P would indeed have negative return of -2.7%. In the year after the rate hike, the market was milder - a flat rate hike would bring the market return of -1.8%, while a steep hike would bring a moderate market return of 4.3%.

In fact, the agency's latest study in 2021 is also available, but their chart is not yet available due to the copyright issue. But we can present the data as below:

12 months before the rate hike

Slow rate hike cycle: 14.7%

Steep rate hike cycle: 16.3%

No obvious rate hike cycle: 16.1%

12 months during the rate hike

Slow rate hike cycle: 10.5%

Steep rate hike cycle: -2.7%

No obvious rate hike cycle: 11.5%

12 months after the rate hike

Slow rate hike cycle: 1.6%

Steep rate hike cycle: 4.3%

No obvious rate hike cycle: 11.8%

If it’s correct that FED will raise the rate for the first time in May next year according to the prediction from Barclays, we should now be at -6 in the chart and we can still expect good earnings this year. In 2022 when the rate hike is almost certain, we expect FED can fully communicate with the market and grasp the pace of rate hikes. But judging from the consistent style of FED led by Powell, there should be a high probability. With the "shadow" of rate hikes, we do need to lower some expectations for yields, but don't panic about it.

Author: Dr.Wei Shi (CIO of Bullseye Financial Ltd, CFA)

The above chart shows a study of Ned David Research Inc. made in 2017 about market trends in all years of rate hikes in the history. They plotted the S&P 500 trends and rates of return from the 12 months before, the 12 months during, and the 12 months after rate hikes.

As we can see, in the year before the rate hike, the return of S&P was about 16%, no matter whether the rate hike cycle was steep or flat or there was no obvious cycle. In the year of rate hike, the S&P could still have a return of about 11% if FED kept in full communication with the market and mastered the appropriate pace of the hikes. If the pace of hikes was too steep, the S&P would indeed have negative return of -2.7%. In the year after the rate hike, the market was milder - a flat rate hike would bring the market return of -1.8%, while a steep hike would bring a moderate market return of 4.3%.

In fact, the agency's latest study in 2021 is also available, but their chart is not yet available due to the copyright issue. But we can present the data as below:

12 months before the rate hike

Slow rate hike cycle: 14.7%

Steep rate hike cycle: 16.3%

No obvious rate hike cycle: 16.1%

12 months during the rate hike

Slow rate hike cycle: 10.5%

Steep rate hike cycle: -2.7%

No obvious rate hike cycle: 11.5%

12 months after the rate hike

Slow rate hike cycle: 1.6%

Steep rate hike cycle: 4.3%

No obvious rate hike cycle: 11.8%

If it’s correct that FED will raise the rate for the first time in May next year according to the prediction from Barclays, we should now be at -6 in the chart and we can still expect good earnings this year. In 2022 when the rate hike is almost certain, we expect FED can fully communicate with the market and grasp the pace of rate hikes. But judging from the consistent style of FED led by Powell, there should be a high probability. With the "shadow" of rate hikes, we do need to lower some expectations for yields, but don't panic about it.

Author: Dr.Wei Shi (CIO of Bullseye Financial Ltd, CFA)

The above chart shows a study of Ned David Research Inc. made in 2017 about market trends in all years of rate hikes in the history. They plotted the S&P 500 trends and rates of return from the 12 months before, the 12 months during, and the 12 months after rate hikes.

As we can see, in the year before the rate hike, the return of S&P was about 16%, no matter whether the rate hike cycle was steep or flat or there was no obvious cycle. In the year of rate hike, the S&P could still have a return of about 11% if FED kept in full communication with the market and mastered the appropriate pace of the hikes. If the pace of hikes was too steep, the S&P would indeed have negative return of -2.7%. In the year after the rate hike, the market was milder - a flat rate hike would bring the market return of -1.8%, while a steep hike would bring a moderate market return of 4.3%.

In fact, the agency's latest study in 2021 is also available, but their chart is not yet available due to the copyright issue. But we can present the data as below:

12 months before the rate hike

Slow rate hike cycle: 14.7%

Steep rate hike cycle: 16.3%

No obvious rate hike cycle: 16.1%

12 months during the rate hike

Slow rate hike cycle: 10.5%

Steep rate hike cycle: -2.7%

No obvious rate hike cycle: 11.5%

12 months after the rate hike

Slow rate hike cycle: 1.6%

Steep rate hike cycle: 4.3%

No obvious rate hike cycle: 11.8%

If it’s correct that FED will raise the rate for the first time in May next year according to the prediction from Barclays, we should now be at -6 in the chart and we can still expect good earnings this year. In 2022 when the rate hike is almost certain, we expect FED can fully communicate with the market and grasp the pace of rate hikes. But judging from the consistent style of FED led by Powell, there should be a high probability. With the "shadow" of rate hikes, we do need to lower some expectations for yields, but don't panic about it.

Author: Dr.Wei Shi (CIO of Bullseye Financial Ltd, CFA)

The above chart shows a study of Ned David Research Inc. made in 2017 about market trends in all years of rate hikes in the history. They plotted the S&P 500 trends and rates of return from the 12 months before, the 12 months during, and the 12 months after rate hikes.

As we can see, in the year before the rate hike, the return of S&P was about 16%, no matter whether the rate hike cycle was steep or flat or there was no obvious cycle. In the year of rate hike, the S&P could still have a return of about 11% if FED kept in full communication with the market and mastered the appropriate pace of the hikes. If the pace of hikes was too steep, the S&P would indeed have negative return of -2.7%. In the year after the rate hike, the market was milder - a flat rate hike would bring the market return of -1.8%, while a steep hike would bring a moderate market return of 4.3%.

In fact, the agency's latest study in 2021 is also available, but their chart is not yet available due to the copyright issue. But we can present the data as below:

12 months before the rate hike

Slow rate hike cycle: 14.7%

Steep rate hike cycle: 16.3%

No obvious rate hike cycle: 16.1%

12 months during the rate hike

Slow rate hike cycle: 10.5%

Steep rate hike cycle: -2.7%

No obvious rate hike cycle: 11.5%

12 months after the rate hike

Slow rate hike cycle: 1.6%

Steep rate hike cycle: 4.3%

No obvious rate hike cycle: 11.8%

If it’s correct that FED will raise the rate for the first time in May next year according to the prediction from Barclays, we should now be at -6 in the chart and we can still expect good earnings this year. In 2022 when the rate hike is almost certain, we expect FED can fully communicate with the market and grasp the pace of rate hikes. But judging from the consistent style of FED led by Powell, there should be a high probability. With the "shadow" of rate hikes, we do need to lower some expectations for yields, but don't panic about it.

Author: Dr.Wei Shi (CIO of Bullseye Financial Ltd, CFA)