What Are The World’s Largest Hedge Funds Investing In?

Technology stocks remain incredibly popular in 2023 where many of the largest US investment funds are being blocked from buying more, due to diversification rules. The S&P500 index has grown 18% this year, however seven large technology stocks have accounted for the majority of the gains. For example, Fidelity’s $108billion Contrafund, could not buy any more shares in Meta, Berkshire Hathaway, Microsoft and Amazon as it made up a combined 32% of it’s portfolio. Blackrock’s Technology Opportunities Fund was also blocked from purchasing more Apple, Microsoft, and Nvidia.

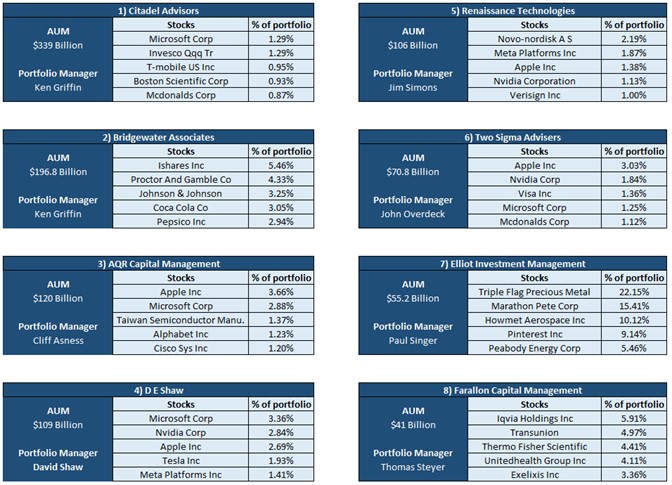

If we were to analyse the hedge fund space, they also have a significant position within technology stocks. Below are the top 8 hedge funds in the world listed in order of their AUM, and names of each portfolio manager. The stocks listed below are the names of the 5 largest positions they hold in their portfolio in terms of weighting.

Apple and Microsoft are clearly a favourite amongst AQR Capital Management, DE Shaw and Two Sigma Advisers where it features in all of their top 5 stock positions, averaging a 3.13% weighting for Apple, and 2.5% weighting for Microsoft. Surprisingly Nvidia only featured as the top 5 investments for Two Sigma and DE Shaw only, whilst DE Shaw are also the only ones that have a significantly large position in Tesla. In terms of weighting across stocks on a fund level, Elliot Investment Management hold 62% of their position across 5 stocks, whilst Citadel only hold 5.33% of their entire portfolio across their 5 largest positions.

Author