Market Data Research: Purchasing Managers Index (PMI)

Why you should watch the Purchasing Managers Index (PMI) data

The Purchasing Managers Index (PMI) is an often-overlooked set of economic data, but that anyone investing and trading in the global financial markets should be aware of. There are various sources of Purchasing Managers Index (PMI), but the main two we will focus on here are the Market global PMI data and the US Institute of Supply Management (ISM) PMI. The PMI data is seen as important as although it is survey data, as opposed to real, actual hard data, the surveys are based on factual information. In addition, the PMI data is seen as a valuable leading indicator for economic conditions.What are Purchasing Managers Index (PMI) data?

Purchasing Managers Index data are based on monthly surveys of businesses in various sectors of an economy. The reason that the survey is based on responses from Purchasing Managers is because these managers have access to data and information that managers in other positions may not have direct access to. Due to the job function of the Purchasing Managers, they are often among the first to see when trading conditions and the performance of a company is changing, either improving or worsening. The panels of the survey look to reproduce the overall sector and whole economy.

A weighting system is included in the survey that weights the survey replies by the relative importance of the sector in which the company operates and by the company size. The PMI surveys are not surveys of opinions and request for factual information only. Therefore, the data represents close to hard data, without actual company figures. Survey questions are of the form “up/down/same” as one month ago and include questions on output, prices employment and new orders.

The PMI data are presented in the form of a diffusion index, ranging from 0-100 with a reading of 50 indicating that the variable is unchanged, below 50 indicates a decline and above 50 an improvement. The further above or below 50, the stronger the change.

The most watched Purchasing Managers Index Surveys released each month are by Institute of Supply Management (ISM) in the US, which covers the US economy and from the Markit Group, which surveys over 28,000 companies across 40 economies. The surveys are broken down into Manufacturing and Non- Manufacturing (or Services) PMI surveys, with Markit Group also producing a Composite Index. Markit Group also releases Flash PMI data, which is an early release of the final data, before all surveys have been completed for a month.

Why PMI is important

Purchasing Managers Index Surveys are important as they are seen as precise indicators of current and future business conditions. In various studies, the PMI data have been shown to accurately predict developing economic trends in official hard data series, such as employment, inflation, Gross Domestic Product (GDP), and industrial production. Because these data sets are seen as a leading indicator for the headline and “real” economy hard data, they are closely monitored by economists, and market analysts and strategists for indications of the future path of economic development. For investors, the Purchasing Managers Index releases can often significantly move financial markets, given their ability to predict economic conditions. Many research strategists have built “risk appetite” indicators built around the Purchasing Managers Index Surveys.

Current PMI indications

At the time of writing, the latest data we have from the US ISM Manufacturing PMI is showing a reading of 57.6 for January versus 58.8 in December. This was a -1.2% change, but is still growing now for 20 straight months, but at a slower pace.

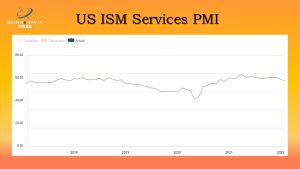

The US ISM Services PMI was 59.9 for January compared to 62.3 in December, a fall of -2.4%, but again has been growing for 20 straight months, but once more at a slower pace.

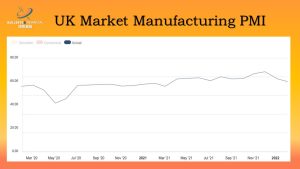

On the Market side, we will look at the UK data, which for the Flash Manufacturing PMI data for February posted at 57.3, unchanged from the January data, again, rising for 20 months.

The Market Flash Services PMI data for February posted at 60.8, up from the 54.1 for January, again still rising for the past 12 months and now accelerating.

For February 2022, both the US and UK Manufacturing and Services PMI readings are rising and maintain multi-month up trends, though in some cases these trends are beginning to slow. This is probably because of rising inflation worries and fears for more aggressive interest rate rises in the future. Data for the coming months should be watched.

Purchasing Managers Index Key Takeaways

- Purchasing Managers Index is a survey of Purchasing Managers that is represented as a diffusion index, with readings above and below 50 signalling an improving or weakening economic outlook respectively

- PMI data important as it an accurate leading indicator of real economy hard data and therefore impacts financial markets

- In February 2022, US and UK PMI data for both Manufacturing and Services are still all in upward trends, though in some instances these trends are beginning to slow. This is likely due to concerns regarding rising inflation and future interest rate increases. The coming months should be closely monitored