Bullseye Financial Global Financial Markets Review – Q1 2022

April 04 2022

March proved to be a crucial month of divided market sentiment, with the first half starting off extremely depressed and mournful. Since the ides of March, or Tuesday the 15th, the broader market began a strong rally through to the end of the month where market sentiment experienced a significant pickup.

All three major U.S. stock indices closed higher on month-end; S&P 500 rose by a total of 3.6%, the Dow Jones Industrial Average gained 2.3% and the Nasdaq rose 3.4%. In Europe, Germany continued to be heavily affected by the Ukraine-Russia conflict, with the DAX down 0.4%. Contrary, the U.K. FTSE 100 was up a modest 0.8%. In the last trading day of March, we saw a decline across the board in the U.S. stock market regardless of sector, stemming from the end-of-quarter institutional repositioning (the selling stocks and buying bonds) after the previous bond market crash.

Despite the March rebound of the stock market, major global indices are still underperforming for the year - year-to-date, the S&P 500 is down a cumulative 5.0%, the Dow Jones Industrial Average is down 4.6%, the Nasdaq is down 9.1%, the German DAX is down 9.6%, with the only contender, the U.K. FTSE 100, is bucking the market with a gain of 1.8%.

Another current market concern is whether the economy will fall into stagflation. Stagflation is inflation in a depressed economy and is something that no central bank ever wants to see. (Refer to our recent insight on Stagflation to learn more) The Fed's current ability to remain hawkish and raise interest rates at a more aggressive pace to fight inflation is also based on the premise of a strong labour market and optimistic expectations for the future economy.

The Bank of England also announced a 25bps rate hike to 0.75% on March 17. The BoE forecasts that UK GDP growth will slow to a low level in 2022, driven by sharp increases in global energy and traded goods prices, followed by further disruptions to the supply chain caused by the Russia-Ukraine conflict. Inflation will peak at 7.25% in April 2022, followed by a decline over time.

Another current market concern is whether the economy will fall into stagflation. Stagflation is inflation in a depressed economy and is something that no central bank ever wants to see. (Refer to our recent insight on Stagflation to learn more) The Fed's current ability to remain hawkish and raise interest rates at a more aggressive pace to fight inflation is also based on the premise of a strong labour market and optimistic expectations for the future economy.

The Bank of England also announced a 25bps rate hike to 0.75% on March 17. The BoE forecasts that UK GDP growth will slow to a low level in 2022, driven by sharp increases in global energy and traded goods prices, followed by further disruptions to the supply chain caused by the Russia-Ukraine conflict. Inflation will peak at 7.25% in April 2022, followed by a decline over time.

At a time when major global central banks turn hawkish to fight inflation, the Bank of Japan remains firm to its accommodative policy of Yield Curve Control in efforts to stimulate the economy. Central Bank Governor Haruhiko Kuroda commented that the policy will remain unchanged even if inflation continues to rise. As a result, the Japanese Yen plummeted to a 6-year low.

On March 28th, the U.S. 5-year and 30-year Treasury yield curves inverted for the first time since 2006, sparking market fears of a recession. More on the yield curve inversions and why central banks are concerned its changes can be found within last month's monthly summary.

At a time when major global central banks turn hawkish to fight inflation, the Bank of Japan remains firm to its accommodative policy of Yield Curve Control in efforts to stimulate the economy. Central Bank Governor Haruhiko Kuroda commented that the policy will remain unchanged even if inflation continues to rise. As a result, the Japanese Yen plummeted to a 6-year low.

On March 28th, the U.S. 5-year and 30-year Treasury yield curves inverted for the first time since 2006, sparking market fears of a recession. More on the yield curve inversions and why central banks are concerned its changes can be found within last month's monthly summary.

The difference between the 10-year and 2-year Treasury yields has also narrowed further. If the 2-year Treasury yields are rising on expectations of a Fed rate hike, why have the 10-year Treasury rates remained low? Interestingly, Powell addressed this question during a Q&A session and had directed partial reasoning to foreign buyers. This "foreign buyer" is likely to be the Bank of Japan, because the country's government bonds must be kept at very low interest rates, the Bank of Japan may consider the U.S. debt is a good investment target.

The difference between the 10-year and 2-year Treasury yields has also narrowed further. If the 2-year Treasury yields are rising on expectations of a Fed rate hike, why have the 10-year Treasury rates remained low? Interestingly, Powell addressed this question during a Q&A session and had directed partial reasoning to foreign buyers. This "foreign buyer" is likely to be the Bank of Japan, because the country's government bonds must be kept at very low interest rates, the Bank of Japan may consider the U.S. debt is a good investment target.

So, if the BoJ fails to control its own yield curve and thus needs more liquidity, will this trigger a sell-off of U.S. Treasuries by the BoJ, causing a further decline in U.S. bond prices or even a global bond collapse? The delicate situation certainly warrants close monitoring for any early signs of deterioration.

While market sentiment picked up at the end of March, we still must caution investors about controlling risk.

Author: Dr. Wei Shi

So, if the BoJ fails to control its own yield curve and thus needs more liquidity, will this trigger a sell-off of U.S. Treasuries by the BoJ, causing a further decline in U.S. bond prices or even a global bond collapse? The delicate situation certainly warrants close monitoring for any early signs of deterioration.

While market sentiment picked up at the end of March, we still must caution investors about controlling risk.

Author: Dr. Wei Shi

Monetary Policies

On March 16th, the Federal Reserve passed its first interest rate hike in three years, in-line with general markets expectation of 25bps. Fed Chairman Jerome Powell indicated that this initial 25bps rate hike is taken with consideration of the high uncertainty brought on by the Russian-Ukrainian conflict to the global economy. He also indicated not ruling out the option of an even more aggressive hike of up to 50 basis point at the next Fed meeting. Powell mentioned that due to factors such as supply chain and geopolitical conflicts, high inflation will persist longer than previously expected. Inflation is anticipated to peak over the first half of this year and estimated to start declining from the second half of the year, eventually dropping down to the target value of 2% by 2023. At this meeting, the Fed also raised its annual inflation forecast from 2.6% to 4.3% and lowered its economic forecast from 4.0% to 2.8%. However, even so, Powell denied the possibility of a recession. He said that with such strong markets demand, the likelihood of a recession is slim. And he stressed that historically, 2.8% is still very strong economic growth and pairing that with the overall U.S. economic fundamentals still being very strong. By March 21st, Fed Chair Powell had re-emphasized that the current U.S. labor market remains very robust and still considering raising rates aggressively if needed to battle high inflation. Powell's “hint” is very obvious that the likelihood of a 50bps rate hike at the May Fed meeting remains high. Both Morgan Stanley and Goldman Sachs lifted their expectations for the Fed to raise rates by 50bps consecutively over May and June’s meeting, and then by 25bps at each meeting after that, with rates ending the year at 2.5%. Citibank holds an even more hawkish stance, with expectations of the Fed to raise rates by 50bps four more times, targeting rates to 2.75% by the end of the year. According to the CME Group, there is a 70% chance that interest rates will rise to 2.5% - 3.0% by the end of the year. Another current market concern is whether the economy will fall into stagflation. Stagflation is inflation in a depressed economy and is something that no central bank ever wants to see. (Refer to our recent insight on Stagflation to learn more) The Fed's current ability to remain hawkish and raise interest rates at a more aggressive pace to fight inflation is also based on the premise of a strong labour market and optimistic expectations for the future economy.

The Bank of England also announced a 25bps rate hike to 0.75% on March 17. The BoE forecasts that UK GDP growth will slow to a low level in 2022, driven by sharp increases in global energy and traded goods prices, followed by further disruptions to the supply chain caused by the Russia-Ukraine conflict. Inflation will peak at 7.25% in April 2022, followed by a decline over time.

Another current market concern is whether the economy will fall into stagflation. Stagflation is inflation in a depressed economy and is something that no central bank ever wants to see. (Refer to our recent insight on Stagflation to learn more) The Fed's current ability to remain hawkish and raise interest rates at a more aggressive pace to fight inflation is also based on the premise of a strong labour market and optimistic expectations for the future economy.

The Bank of England also announced a 25bps rate hike to 0.75% on March 17. The BoE forecasts that UK GDP growth will slow to a low level in 2022, driven by sharp increases in global energy and traded goods prices, followed by further disruptions to the supply chain caused by the Russia-Ukraine conflict. Inflation will peak at 7.25% in April 2022, followed by a decline over time.

Bond Decline Intensifies as Yield Curve Inverts

On March 28th, the yield on Japan's 10-year government bond (JGBs) continued to rise to 0.25% even after the BOJ announced that it would buy an unlimited amount of government bonds at a fixed rate to keep its yields below the upper edge of the central bank's policy range, and then announced another bond purchase. This was the second such move in less than two months, and by the next day, the 10-year Japanese government bond yield continued to rise by more than 0.25% (see chart below), indicating a sizeable amount of short selling in the market on the JGBs. At a time when major global central banks turn hawkish to fight inflation, the Bank of Japan remains firm to its accommodative policy of Yield Curve Control in efforts to stimulate the economy. Central Bank Governor Haruhiko Kuroda commented that the policy will remain unchanged even if inflation continues to rise. As a result, the Japanese Yen plummeted to a 6-year low.

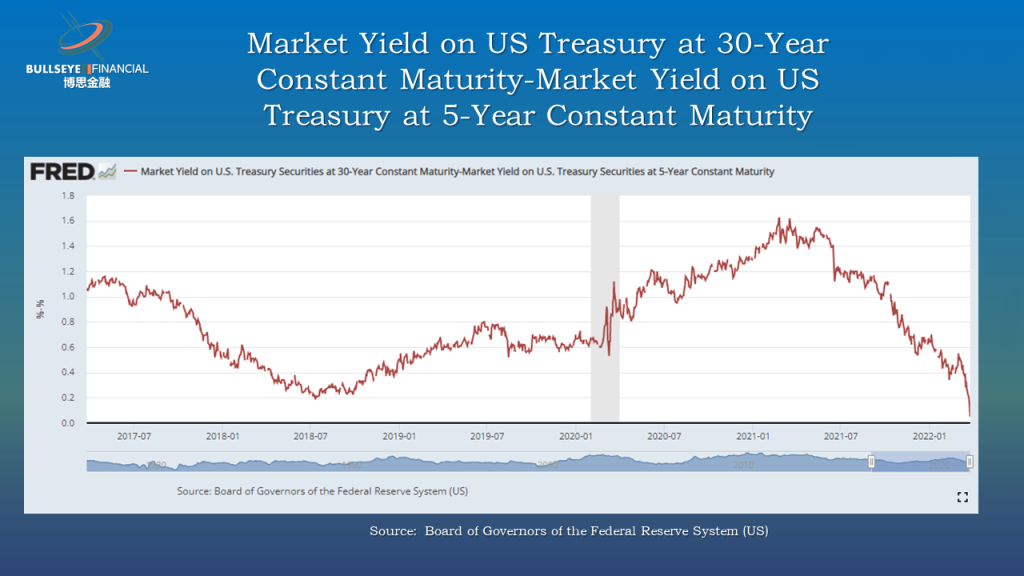

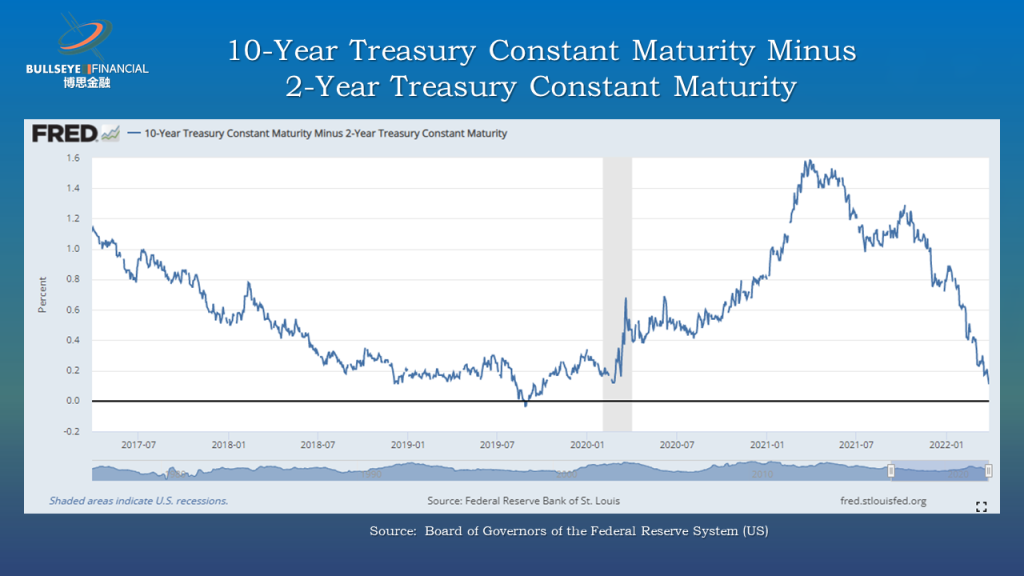

On March 28th, the U.S. 5-year and 30-year Treasury yield curves inverted for the first time since 2006, sparking market fears of a recession. More on the yield curve inversions and why central banks are concerned its changes can be found within last month's monthly summary.

At a time when major global central banks turn hawkish to fight inflation, the Bank of Japan remains firm to its accommodative policy of Yield Curve Control in efforts to stimulate the economy. Central Bank Governor Haruhiko Kuroda commented that the policy will remain unchanged even if inflation continues to rise. As a result, the Japanese Yen plummeted to a 6-year low.

On March 28th, the U.S. 5-year and 30-year Treasury yield curves inverted for the first time since 2006, sparking market fears of a recession. More on the yield curve inversions and why central banks are concerned its changes can be found within last month's monthly summary.

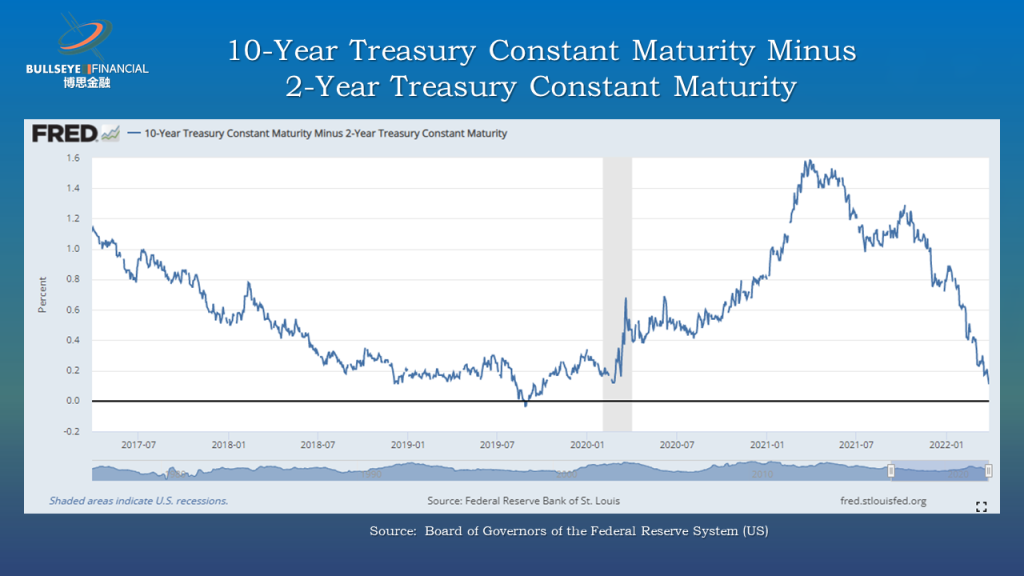

The difference between the 10-year and 2-year Treasury yields has also narrowed further. If the 2-year Treasury yields are rising on expectations of a Fed rate hike, why have the 10-year Treasury rates remained low? Interestingly, Powell addressed this question during a Q&A session and had directed partial reasoning to foreign buyers. This "foreign buyer" is likely to be the Bank of Japan, because the country's government bonds must be kept at very low interest rates, the Bank of Japan may consider the U.S. debt is a good investment target.

The difference between the 10-year and 2-year Treasury yields has also narrowed further. If the 2-year Treasury yields are rising on expectations of a Fed rate hike, why have the 10-year Treasury rates remained low? Interestingly, Powell addressed this question during a Q&A session and had directed partial reasoning to foreign buyers. This "foreign buyer" is likely to be the Bank of Japan, because the country's government bonds must be kept at very low interest rates, the Bank of Japan may consider the U.S. debt is a good investment target.

So, if the BoJ fails to control its own yield curve and thus needs more liquidity, will this trigger a sell-off of U.S. Treasuries by the BoJ, causing a further decline in U.S. bond prices or even a global bond collapse? The delicate situation certainly warrants close monitoring for any early signs of deterioration.

While market sentiment picked up at the end of March, we still must caution investors about controlling risk.

Author: Dr. Wei Shi

So, if the BoJ fails to control its own yield curve and thus needs more liquidity, will this trigger a sell-off of U.S. Treasuries by the BoJ, causing a further decline in U.S. bond prices or even a global bond collapse? The delicate situation certainly warrants close monitoring for any early signs of deterioration.

While market sentiment picked up at the end of March, we still must caution investors about controlling risk.

Author: Dr. Wei Shi