How time flies! The year 2021 has come to an end. People have gradually learned to return to their daily routines despite the protracted COVID-19 pandemic this year. Compared to 2020 with frequent black swan events, 2021 was not so heart-stopping but managed to remain colourful and exciting.

Year in review

The stories of the financial market in 2021 began with the GameStop (GME) short squeeze that took place on January 11

th. In this event initiated by individual investors on Reddit claiming to assemble global individual investors against Wall Street short-selling institutions, two issues were propelled into the spotlight: the market position of Meme stocks driven by sentiments began to emerge, which indirectly reflected the rise of individual investors; the vulnerabilities of broker-dealers' trading systems were thoroughly exposed in this short squeeze; after the occurrence of the uncontrollable margin trading risk following the surge in GME stock price, broker-dealers such as Robinhood and TD Ameritrade prohibited individual investors from buying stocks to further squeeze short-selling institutions, which caused huge losses to buying-long investors.

From late February, small-cap stocks that had great performance in the previous year and stocks benefiting from COVID-19 began to fall back sharply, and back then, investors fanatically chasing to buy the stocks when their prices are rising might not realize that they would perform so dismally for the rest of the year. Those stocks included Peloton (related to at-home fitness), Zoom (related to online meetings), Chegg (related to online education), and Teledoc (related to telemedicine). We hold that the main reason for the significant valuation corrections of those stocks was that with the restart of the economy, benefits for those companies from COVID-19 disappeared, the demand for their products started to decline, the stunning growth rate shown by them previously might not continue, and they were thus battered due to the high premiums enjoyed by them.

The ARK funds led by Catherine Wood, also known as the female version of Buffett on Wall Street, have poor performance this year, with the flagship product ARKK losing more than 20%, while the rate of return of S&P 500 exceeded 25% over the same period. There are many institutions and products that short sell ARK funds, however, they are not the main reason for the decline of ARK funds. Catherine Wood has repeatedly emphasized that the investment horizon for ARK is five years as it takes time to incubate the breakthroughs and innovation of many technologies. Therefore, investors should be more patient if they agree with her philosophy.

The U.S. President Biden announced a USD $2.3 trillion infrastructure plan in March to boost the U.S. economy and increase employment with fiscal stimulus, however, since proposed, the plan had faced major hurdles, and Biden had to repeatedly compromise time and time again. By the end of June, the USD $1.2 trillion version had shrunk by 52% from the initial plan, and then through a convoluted process of voting by the Senate, the plan was not passed until November 6

th. The market loves to see this result because the shrinking of the infrastructure plan avoided the implementation of the proposal to support this huge plan by raising taxes, which had been repeatedly emphasized by Biden previously.

2021 was not friendly to investors who favor China concepts stocks. China concepts stocks began a plunging year from the forced liquidation of Bill Hwang's family fund Archegos in March. As the buzz of "individual investors vs Wall Street" in January had not died down, most institutions interpreted the collective plunge of China concepts stocks back then as another short squeeze triggered by high leverage and considered it a one-off event with limited impact. However, investors have been overwhelmed by the series of policy risk events that followed, including education and training institution crackdown, game controls, Evergrande's crisis, and Didi's delisting. China concepts stocks have overall fallen more than 40% in 2021.

Speaking of the long "shadow" cast over the entire 2021, it must be the global supply chain crisis and high inflation. Here is an explanation for the causes of high inflation using the supply-demand relationship:

Supply shortage:

Supply chain crisis caused by COVID-19;

Temporary or permanent loss of labor caused by COVID-19, lockdown, and financial subsidies, increasing enterprises' labor costs and even causing them to be not able to start operation;

Strong demand:

Rises in asset prices (stock market and housing market) and increases in disposable cash of people owing to the easy monetary policy (the pump priming of the Federal Reserve and the low interest rates of central banks), driving the consuming desires

New consumer demand of people as prompted by the change in lifestyle as a result of telecommuting

A rise in the saving rate (from 8% before COVID-19 to more than 20% during COVID-19 for the U.S. residents) and unleashing of consuming desires suppressed by COVID-19

Governments are actively taking measures, for example, the Biden administration tries to ease supply chain strain by easing congestion at ports and increasing transport capacity, and the British government issues short-term work visas to truck drivers to ease insufficient transport capacity, however, according to the current data, the supply chain problem has not been effectively solved, and the circumstance of supply falling short of demand will continue into the next year.

The continuing high inflation has become an important reason for the Federal Reserve to shift from the dovish stance to the hawkish stance at the end of 2021. Powell who had insisted that "inflation is temporary" proposed for the first time in late November that "temporary" may not be appropriate to describe the current inflation, he admitted that the Federal Reserve's previous over-optimistic expectation of inflation was a mistake and considered that inflation would continue into 2023, and furthermore, Powell also said that tapering should be accelerated to leave enough policy space to control inflation. This change in the attitude of the Federal Reserve brings many uncertainties to the coming 2022. To respond to high inflation, the UK unexpectedly announced to raise interest rates by 15 basis points in early December. Currently, the European Central Bank still insists on not raising interest rates, however, the pressure brought by high inflation on central banks and governments can already be seen.

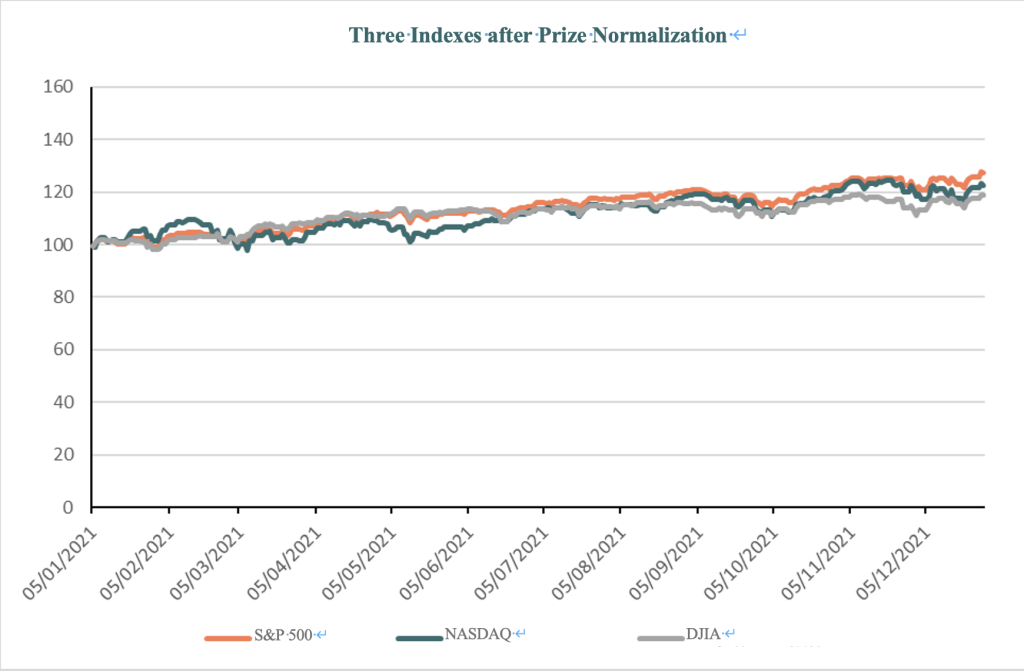

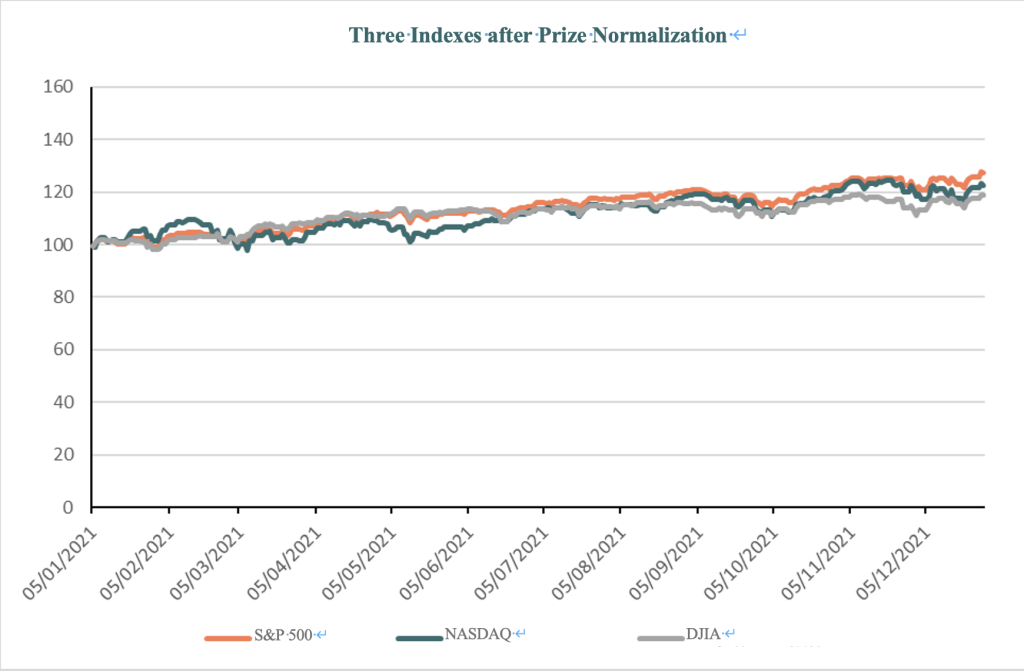

After a brief review of the colorful and exciting 2021, now let's take a look at the performance of the three major U.S. stock indices and various industry sectors:

S&P 500

Jan – Dec 2021

S&P 500 / NASDAQ / DIJA

Jan – Dec 2021

As of December 28

th, the S&P 500 has overall been up 27.43% (4,786 points), the DJIA has overall been up 18.92% (36,398 points), and the NASDAQ has overall been up 22.45% (15,782 points) in 2021.

At the end of 2020, we shared with you the major investment institutions' predictions of the S&P 500 in 2021, as shown in the following figure, and now it seems that even the most optimistic J.P. Morgan still underestimated the performance of the S&P 500 in this year.

Analyst Targets for S&P 500 by End of 2021

|

Institution of analyst

|

Target |

| J.P. Morgan |

4,400 |

| Invesco |

4,350 |

| Goldman Sachs |

4,300 |

| Oppenheimer |

4,300 |

| Piper Sandler Companies |

4,225 |

| BMO |

4,200 |

| UBS |

4,100 |

| CFRA |

4,080 |

| Barclays |

4,000 |

| BTIG |

4,000 |

| Deutsche Bank |

3,950 |

| Morgan Stanley |

3,900 |

| Wells Fargo |

3,900 |

| Citibank |

3,800 |

| Bank of America |

3,800 |

| Stifel Financial Corp. |

3,800 |

In terms of sectors, the ones with the best performance in 2021 are energy and real estate. The strong performance of energy mainly benefits from the supply-demand relationship under the international political situation, and energy and real estate both benefit from inflation. It's worth noting that Tom Lee, renowned Wall Street investor, former J.P. Morgan chief strategist and Fundstrat partner, expressed his optimism about the energy sector in early 2021, but not many people agreed with him back then. The reason for his optimism about the energy sector was that the sector had long lacked CapEx but the demand had not decreased. In terms of valuation, the sector had long been undervalued by the market and in the deep value territory.

| Sector/industry (as of December 28) |

Price change in the year |

| Communication services |

24.97% |

| Consumer discretionary |

26.63% |

| Consumer staples |

15.34% |

| Energy |

48.84% |

| Financials |

35.61% |

| Health care |

26.36% |

| Industrials |

19.41% |

| Information technology |

36.86% |

| Materials |

25.10% |

| Real estate |

42.73% |

| Utilities |

14.40% |

| S&P 500 |

27.43% |

Now, let's shift our focus to the other side of the ocean and look at how the major European indices performed in 2021:

FTSE100 / DAX

Jan – Dec 2021

As of December 28

th, the FTSE 100 has overall been up 14.11% (7,372 points) and the German DAX has overall been up 16.36% (15,964 points). Both indices show the rapid recovery of the European economy in the post-COVID-19 era, however, they are still not as strong as the U.S. indices.

Global Major Indices

Jan – Dec 2021

So, what is our outlook for the capital markets in 2022? In which industries can we identify opportunities and specific risks we’ll need to pay attention on? We will detail them in our next article.

Author: Dr.Wei Shi (CIO of Bullseye Financial Ltd, CFA)