2022 Q1 Institutional Form 13F Quarterly Report Analysis

Recently, major investment institutions have submitted their 13F reports for Q1 of 2022 to the U.S. Securities and Exchange Commission (SEC), announcing changes in their own positions. The 13F reports, which are required by the SEC to be filed within 45 days of the end of each quarter by investment institutions with more than $100 million in assets under management (AUM), disclose their own equity and bond holdings and provide the SEC with a report on the fund flows.

Let’s zoom in to the top 10 most recognized institutions for a closer look at their reporting.

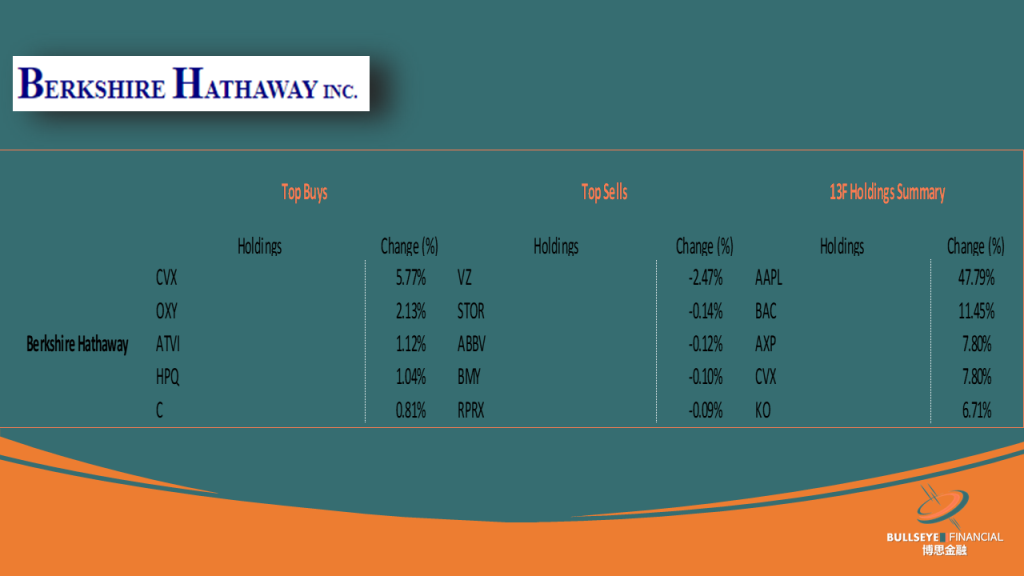

Let’s start from the highly-reputable Berkshire Hathaway (BRK), helmed by Warren Buffett, also known as the “Oracle of Omaha” and one of the most successful investors of all times.

Berkshire made a significant buy just this past quarter, reducing its huge cash reserve holdings of $145.7 billion to $106.3 billion, reaching its lowest point in nearly 3 years. Berkshire continued to significantly increase its holdings in the energy sector leader - Chevron - this quarter, following significant increases in this stock in the last two quarters. In addition to Chevron, Berkshire also invested in Occidental Petroleum.

In addition, Berkshire started investing in Citibank, having bought 55,155,797 shares. Currently, Citibank ranks 15th of Berkshire's holdings. Berkshire started to increase its holdings in the banking sector in 2018 and sold off most of them in 2020, leaving only Bank of America.

Warren Buffett explained at the 2021 AGM: "I like banks in general, I just don't like our current holdings." It is evident that in the early stages of the outbreak, Berkshire chose to reduce its position in the banking sector to reduce its risk exposure to global trading and the investment banking sector.

Citibank is down 40% over the last 12 months, while the Financial Sector ETF is down about 12% over the same period. While the stock's decline presents better buying opportunities, Citibank's 4% dividend yield has certainly attracted Berkshire, which values cash inflows.

In terms of top sales, Berkshire almost liquidated its position in the telecommunications giant, Verizon, it has been just 1.5 years since Berkshire started investing in this company, and the close of this investment led to an 8% loss. Berkshire might have found Verizon’s dividend income appealing at first but have been disappointed with the company’s fundamentals later on and therefore, rebalanced its portfolio holdings.

In addition, Berkshire also liquidated its positions in pharmaceutical companies including AbbVie and Bristol Myers Squibb. Later in this article we will see more financial institutions reduce or liquidate their positions in pharmaceutical stocks in the first quarter.

Due to the significant increase in Chevron, Berkshire's top 5 holdings are now Apple, Bank of America, American Express, Chevron and Coca-Cola.

Next, let's turn our attention to the investment banks.

Goldman Sachs have been actively longing the S&P 500 index last quarter, buying calls on the S&P 500 ETF in addition to the S&P 500 ETF. On the other hand, Goldman Sachs bought puts on the Russell 2000 ETF to protect its small- and mid-cap positions considering the pressure the small- and mid- cap companies would endure under Fed's tightening monetary policy.

In addition, we know that Goldman Sachs continued to buy Alibaba against the market in the second and third quarters of 2021, when major institutions were reducing their holdings and liquidating their positions in the Chinese stocks. Goldman Sachs reduced its stake in Alibaba by 8.2 million shares in the fourth quarter of last year, partially "stopping out" on the deal. Over the past quarter, Goldman Sachs continued to sell Alibaba.

Like Goldman Sachs, Morgan Stanley also increased its holdings in the S&P 500 ETF in the last quarter. Among its top 5 buys we have also seen increased holdings of blue chips with sound performance such as Amgen and TSMC, and only one growth stock - the South American e-commerce company Mercado Libre. Morgan Stanley also increased its holdings of long-term U.S. Treasury ETFs. This is an indication that Morgan Stanley is not optimistic about the short-term economic outlook and has therefore adopted a defensive asset allocation strategy.

Morgan Stanley continued to reduce its holdings in growth stocks in the last quarter, such as Roblox, a "metaverse" stock, Snowflake, which specialised in cloud computing, and Twillio, a cloud communications stock.

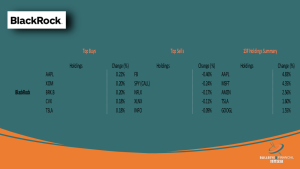

Next, let's take a look at the actions of BlackRock, the world's largest asset management group.

Over the first quarter of 2022, BlackRock also significantly increased its holdings in energy stocks, with two energy stocks - ExxonMobil and Chevron - included in its top 5 buys. The other three were Apple, Berkshire Hathaway and Tesla.

In terms of reduced positions, BlackRock significantly reduced its holdings in Meta Platforms, whose shares plunged 33% in the first quarter of 2022, with analysts generally concerned about the lack of growth in Meta's Facebook users and the decline in advertising revenue due to Apple's privacy policy.

On the other hand, Meta's heavily invested metaverse business will not be profitable in the short term, and CEO Zuckerberg indicated at the earnings meeting that the company will try to reduce operational spending in 2022. Recently we also saw the news that Meta suspended recruiting new employees.

Among BlackRock's top 5 sells, we saw a reduction in its holdings in data platform IHS Markit. In addition to BlackRock, several other institutions have reduced their holdings in this company, including Temasek, Soros Fund Management and Vanguard. This is not really because these institutions are no longer bullish on the company, but due to the takeover by S&P. An analysis of the holdings of Temasek, which is heavily invested in IHS Markit, clearly shows that its holdings of IHS Markit stock were exchanged for S&P shares.

The changes in the positions of the world's leading asset managers Soros Fund, Vanguard, Bridgewater, and Baillie Gifford are listed as below.

Soros Fund Management continued to significantly increase its holdings in electric vehicle stock Rivian this past quarter, making it the fund's top position at 15%. In addition to the stock, Rivian calls also take up the fund's fourth largest position at 4.6%, indicating the fund’s strong bullish view on Rivian. Rivian, the highly touted "Tesla challenger," fell 52% YTD March and 73% YTD May 23. Soros Fund Management, which is heavily invested in Rivian, would have seen a significant unrealized loss should it not do an effective job in hedging.

Vanguard's top 5 buys are the same as BlackRock's, the difference only lies in the ranking - they are Apple, Tesla, Chevron, ExxonMobil and Berkshire Hathaway. These 5 companies serve well to diversify risk, as they are in the high-tech, electric vehicle, oil, financial, consumer goods and infrastructure sectors, and are market leaders in their respective fields.

Bridgewater continues to increase its weight in emerging market ETFs in the first quarter of 2022. Consumer stocks have been dominating Bridgewater's positions, with its second largest position in the leading consumer staple stock Procter & Gamble, and while P&G has not reported earnings as of this writing, other consumer stocks such as Walmart and Target have triggered selloffs due to poor earnings reports. Supply chain disruptions, rising costs, and continued high inflation have put considerable pressure on these consumer goods companies, and they have thus chosen to lower their profit estimates for 2022.

In addition, Bridgewater's bullishness on Chinese stocks continued. Among its holding of 46 Chinese stocks, Bridgewater has added in 35 and reduced in 10 of them, but the overall weighting of these Chinese stocks declined from about 10% in the fourth quarter of 2021 to about 9% in the first quarter of 2022 because of the downward movement of Chinese stock prices along the way. Bridgewater continued to increase its position in Alibaba by 3,221,000 shares in the past quarter.

Baillie Gifford reduced its holdings in e-commerce stocks Shopify and Wayfair, as well as vaccine stock Modena in the last quarter. In the post-epidemic era with supply chain disruptions and rising labour costs, e-commerce stocks, represented by Amazon, have been generally underperforming. In terms of buys, Baillie Gifford added positions in South American e-commerce company Mercado Libre and Korean e-commerce company Coupang, which shows that the institution is still long the e-commerce players but has made a change in stock selection.

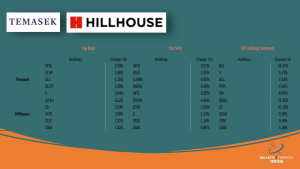

Finally, let's move our attention to the Asian investment companies.

Hillhouse has significantly increased its holdings in takeaway delivery stock DoorDash and e-commerce stock JD in the past quarter. 13F reports that as of March 31, JD accounted for the second largest position in Hillhouse at 10.2% and DoorDash was in the third largest position at 9.5%.

Temasek's positions are more "globally focused" as compared to the "Asia Pacific focused" Hillhouse - the top 5 positions are BlackRock, Visa, Bill.com, PayPal and Mastercard. In addition, Temasek's move to increase its holdings in US Treasuries in the first quarter demonstrates its risk aversion view - increasing cash position to reduce risk and increase liquidity.

Author - Dr. Wei Shi