2021 Q3 Institutional Form 13F Quarterly Report Analysis

Recently, major investment institutions have submitted their 13F reports to the U.S. Securities and Exchange Commission (SEC) for Q4 of 2021. The 13F reports, which are required by the SEC to be filed within 45 days of the end of each quarter by investment institutions with more than $100 million in assets under management (AUM), disclose their own equity and bond holdings and provide the SEC with a report on the fund flows.

Let's zoom in to the top 10 most recognized institutions for a closer look at their reporting.

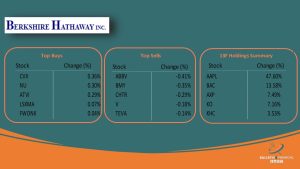

Let's start from the highly-reputable Berkshire Hathaway (BRK), helmed by Warren Buffett, also known as the “Oracle of Omaha” and one of the most successful investors of all times.

Berkshire Hathaway added most to its holdings in Chevron (CVX), the energy sector conglomerate over this past quarter, perhaps strengthening Berkshire's view that inflation will continue. They’re also gearing strongly towards the view of oil prices to remain high due to supply chain disruptions and escalating geopolitical confits between Russia and Ukraine.

In addition, Berkshire's move to buy Activision Blizzard (ATVI) also raised market concerns. On January 18, 2022, Microsoft announced their intentions to buy Activision Blizzard at $95 per share, a premium of about 45%. As Warren Buffett and Microsoft's former CEO Bill Gates are close friends, markets speculated whether this relationship facilitated Berkshire's foresight to buy Activision Blizzard before the acquisition news was officially released. Activision Blizzard closed at $81 on Feb. 18, 2022, and Buffett responded on same day indicating the transaction was conducted by an independent investment manager and disclosed that the average cost price was $77, deniing any involvement of insider trading.

Berkshire's top 5 positions, nearly 80% of their total positions, continue to include Apple (AAPL), Bank of America (BAC), American Express (AXP), Coca-Cola (KO) and Kraft Heinz (KHC). In the fourth quarter of 2021, Berkshire opened 3 new positions, topped up 4 stocks (with the most additions to Chevron), liquidated 2 stocks (SIRI and Teva Israel), and reduced positions across 8 other stocks. In terms of sectors, the reduced or liquidated stocks are mainly in the Financials and Health Care sectors.

Next, let's turn our attention to investment banks.

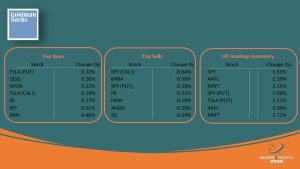

In the second and third quarters of 2021, Goldman Sachs (GS) continued to buy Alibaba (BABA), increasing their holdings in Chinese stocks while major institutions headed in the opposite direction of reducing holdings or liquidating their Chinese stocks holdings. However, over the fourth quarter, Goldman Sachs lowered its stakes in Alibaba by 8.2 million shares, seemingly "stopping out" of the deal at least partially. Along with their Alibaba stocks, Goldman Sachs also significantly reduced their holdings in traditional value stocks such as AT&T (T), Intel (INTC) and Citibank (C).

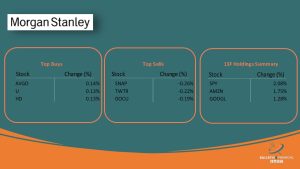

Morgan Stanley added to its holdings in the S&P 500 ETF (SPY), Apple (AAPL), Broadcom (AVGO) and Home Depot (HD), all large-cap ETFs and blue chips with solid fundamentals. Notably, they’ve also added to its holdings in Unity Software Inc. (U), a growth stock which operates a real-time 3D development platform. They delivered satisfactory results in the past earnings season with strong potentials in VR and AR to benefit from the much-publicised metaverse space.

At the same time, Morgan Stanley also reduced its holdings of growth stocks such as Square (SQ), Snap (SNAP), DocuSign (DOCU) and Twitter (TWTR), which had all underperformed over past six months. The growth stocks which have yet to be profitable are less favourable due to the general environment of the highly-anticipated interest rates hikes as foreshadowed by central banks in the near future.

In addition, Morgan Stanley significantly reduced its holdings in Amazon (AMZN), whose e-commerce business is underperforming due to supply chain pressure, rising labour costs and the gradual recovery of offline shopping in the post-epidemic era.

Next, let’s review the dealings from BlackRock (BLK), the world's largest asset management group with an active AUM upwards of $10 trillion USD.

Morgan Stanley added to its holdings in the S&P 500 ETF (SPY), Apple (AAPL), Broadcom (AVGO) and Home Depot (HD), all large-cap ETFs and blue chips with solid fundamentals. Notably, they’ve also added to its holdings in Unity Software Inc. (U), a growth stock which operates a real-time 3D development platform. They delivered satisfactory results in the past earnings season with strong potentials in VR and AR to benefit from the much-publicised metaverse space.

At the same time, Morgan Stanley also reduced its holdings of growth stocks such as Square (SQ), Snap (SNAP), DocuSign (DOCU) and Twitter (TWTR), which had all underperformed over past six months. The growth stocks which have yet to be profitable are less favourable due to the general environment of the highly-anticipated interest rates hikes as foreshadowed by central banks in the near future.

In addition, Morgan Stanley significantly reduced its holdings in Amazon (AMZN), whose e-commerce business is underperforming due to supply chain pressure, rising labour costs and the gradual recovery of offline shopping in the post-epidemic era.

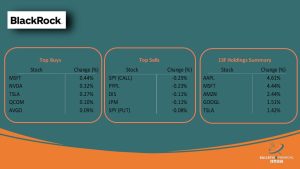

Next, let’s review the dealings from BlackRock (BLK), the world's largest asset management group with an active AUM upwards of $10 trillion USD.

BlackRock increased its holdings in large-cap blue chips Microsoft (MSFT), Nvidia (NVDA), Tesla (TSLA), Qualcomm (QCOM) and Broadcom (AVGO) in the fourth quarter of 2021. We see that three of the increased holdings are in the semiconductor chip industry, which provides a glimpse of BlackRock's bullishness on the sector. On the downgrade side, BlackRock reduced its holdings in payments giant PayPal, whose shares took a deep sharp dive following its past earnings meeting, mainly due to a less-than-expected outlook for the first half of 2022. The main driving factor of the downgraded outlook, in addition to the gradual recovery of offline shopping, is PayPal's underestimation of the legacy effects from its separation with eBay.

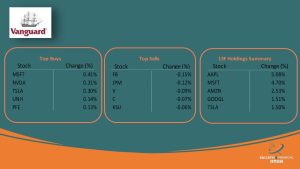

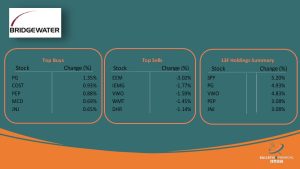

The changes in the positions of the world's leading asset managers including Soros Fund, Vanguard Group, Bridgewater and Baillie Gifford are as follows.

The Soros Fund has increased its holdings in Rivian Automotive, Inc (RIVN), manufacturer of electric vehicles over the past quarter and also invested in convertible bonds of Sea Ltd, known as "Tencent of the Southeast Asia" which has shown good upside momentum in 2021 while also being very resilient during market corrections. However, Sea's share price has pulled back sharply into 2022 because of the change in market sentiment.

Vanguard Group's position, in line with BlackRock's, is "heavily weighed" on large-cap blue chips - Apple, Microsoft, Amazon, Google and Tesla. In the past quarter, Vanguard Group reduced its holdings in financial stocks including JP Morgan, Visa and Citibank. Sharing similar views with Berkshire Hathaway and BlackRock, Vanguard Group does not appear to be bullish on financial stocks for the first half of 2022.

Similar to last quarter, Bridgewater continued to buy consumer essential companies which have pricing power in Q4 2021, including Procter & Gamble and Johnson & Johnson, to remain defensive in a rising inflationary environment. The most reduced holdings are in emerging market stocks, and the logic behind this should be - the dollar will continue to strengthen in an environment where the Fed will raise interest rates 4-6 times. And with a stronger dollar, money will flow back to the United States from emerging markets.

It is also worth noting that Bridgewater's action on Chinese stocks follows Ray Dario's long-standing bullish view on China, continuing to add to its positions in Alibaba (+29%), JD (+33%) and PDD (+38%) in the fourth quarter of last year.

Baillie Gifford (USA.L) cut back significantly on Alibaba (BABA) last quarter, as well as on Zoom (ZM), the telecommuting software company that made a splash during the epidemic, and continued its style to invest in slightly "niche" names. But it's important to know that Baillie Gifford was firmly long when Tesla (TSLA) was still a "niche" name, and as a long-term value investor, these names may be worth waiting for.

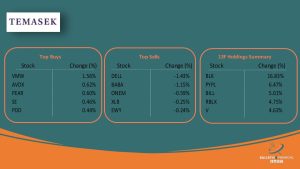

Finally, let's move our attention to Asian investment institutions.

Both Temasek and HillHouse Capital have significantly reduced their holdings in Alibaba in the past quarter. HillHouse has also reduced its holdings in popular Chinese stocks PDD and BiliBili. Since the second half of 2021, Chinese stocks have been negatively affected by news and events and we have seen many institutional investors reduce their holdings or liquidate their positions to avoid risk. Temasek and HillHouse, which are Asia-Pacific-focused, have not completely abandoned Chinese stocks - Temasek increased its holdings in PDD in the fourth quarter, and HillHouse increased its holdings in Li, an auto manufacturer and YSG, an e-commerce company.