US Largest Banks Beat Expectations

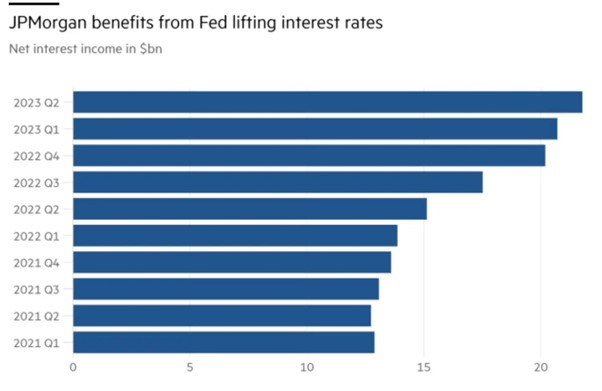

JP Morgan, Citi, and Wells Fargo comprise the three largest US banks, and they all have surprised everyone with very good results on Friday due to a surge in profits. The key catalyst of the profits has arisen from charging more for loans due to the successive Federal Reserve rate hikes.

It wasn’t long ago that the banking sector was in a crisis due to the Deutsche and Credit Suisse issues, however higher interest rates have collectively earned the 3 banks nearly $50bn in net interest income. This is defined as the difference between what they charge on loans and pay out on deposits. Key data includes these increases compared to the same time last year:

- JP Morgan climbing 44%

- Citi climbing 16%

- Wells Fargo climbing 29%

Source from: Company statments, Bloomberg

Although rising interest rates benefit the banks as above, this is not always good news. As further interest rate hikes occur, there is a further possibility for loans to default which banks must prep for. For example, JP Morgan has set aside a net $1.5bn to cover potential losses. Furthermore, smaller banks have come under more pressure to increase rates which have hurt their profit margins.

On the investment management side, the world’s largest investment manager Blackrock closed the quarter with $9.4 trillion in assets under management, which beat their profit expectations. This increase came as investors pumped more money into its funds due to a more bullish market.

Author: Joshua Clement