The Impacts of Geopolitical Events to Stock Markets

Recently, the recurring geopolitical conflict between Russia and Ukraine has triggered significant shocks throughout global financial markets. On February 12th, the U.S. national security adviser said at a White House press conference that the Russian-Ukrainian conflict has the potential to escalate and suggested that Americans staying in Ukraine should quickly evacuate within the next 24 to 48 hours.

Events of February 14th

The U.S. stock market on February 14th was extremely volatile from the ongoing back-and-forth news updates between Russia and Ukraine. The futures index fell in response to a pre-market statement made by G7 finance ministers regarding the imposing of economic and financial sanctions on Russia if they proceed with an invasion of Ukraine.

Later on, the Russian foreign minister updated that problems could continue to be resolved through diplomatic means, and the futures index rebounded. In the early trading session, the Secretary General of the Security Council of Ukraine believed that Russia would not launch a full-scale attack on Ukraine in the next few days, and the market found a flooring and rose once again.

However, following their scheduled lunch, the market dove off of a statement from Ukrainian President Zelensky indicating that Ukraine had been informed February 16th would be the imminent date when Russia would launch their attack. The broader market reacted yet again until an hour and a half before market close when the U.S. Department of Defense spokesman said he still did not believe Russian President Vladimir Putin had made the decision to attack Ukraine.

The drama playing out throughout the day surely left many market participants both physically and mentally exhausted as market movements were mainly reactionary to the latest headlines.

Let's now take a look at how historical geopolitical conflicts have truly impacted the stock market and the results may prove surprising.

Geopolitical Events Since 1941

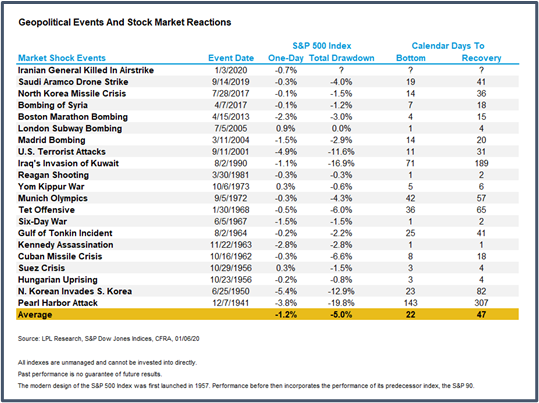

The chart below, as published by LPL Research, highlight the rise and fall of the S&P500 index on the exact day of key geopolitical events since the attack on Pearl Harbour in 1941, as well as the number of trading days the index bottomed out and the total trading days for full recovery to pre-conflict positions.

As highlighted by the LPL Research, the most significant event of the millennium was none other than the September 11 attack in the U.S. On the day of the terrorist attack, the S&P fell 4.9% for a total of 11 days, bottoming out after a total drawdown of 11.6% which took 31 calendar days to recover to pre-attack levels. It proved also to become one of the most volatile of all post-millennium geopolitical conflicts.

From the research, it is clear that the impact of such geopolitical tensions to the markets is temporary and does not affect the market in a fundamental, long-term manner. As the same rings true towards the current Russia-Ukraine conflict, appropriate risk management calls for reduction of market operations through the erratic volatility driven by market fears and uncertainties.

Author: Dr. Wei Shi - CIO/Director Source: Special Report by LRL Research How Stocks Do During Geopolitical Events Posted by lplresearch https://lplresearch.com/2020/01/08/how-stocks-do-during-geopolitical-events/