Market Scenario Analysis: UK Consumer Price Index (CPI) in focus

UK Inflation Data in the Spotlight

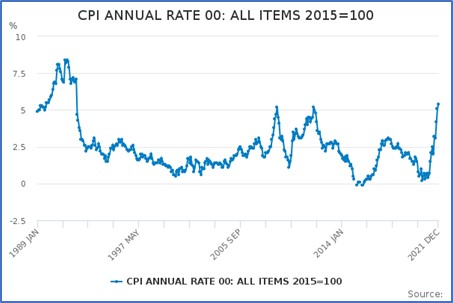

For the UK financial markets, the standout data point this coming week will be the UK inflation data for January released on Wednesday 16th February. This data comes on the back of the release last week of the US Consumer Price Index (CPI) data, which came in above consensus of 7.3%, positing a 7.5% rise on an annual basis, which sent US yields spiking higher and impacted negatively on US and global equity markets.

Why is the UK Inflation Report Particularly in Focus?

Inflation fears have been mounting in the UK, and globally, throughout 2021, with global prices driven higher by supply chain issues, at least partially due to the global COVID-19 pandemic. In addition, in the UK there is some data that suggest that Brexit is also having an impact on pushing prices higher. And globally, labour markets are very tight, with many of the major global economies running at or close to full employment as economies have recovered strongly in the wake of the pandemic.

Although central banks, including the Bank of England, had looked for the increases in inflation and rising CPI data to be transitory in 2021. But the ongoing high levels of price increases have seen global central banks shift their views on inflation in late 2021 and into 2022. Global central banks are becoming more hawkish, meaning more focused on the higher inflationary pressures and in turn have indicated a willingness to increases interest rates more aggressively (from extremely low levels due to the global pandemic).

So, not only is inflation a negative from an economic growth perspective, as it leads to uncertainty, but it is also increasingly the likelihood of more aggressive than anticipated increases in interest rates.

What does the Bank of England Say?

The Bank of England have already raised interest rates twice on the current cycle, arguably the most hawkish move from the major global central banks, increasing rates by 0.15% in December then up another 0.25% higher in early February. In fact, the vote in February was close to increasing rates by 0.50%, meaning the expectation is for another rate rise of 0.25% on the 17th of March meeting.

At the last meeting the Bank of England Monetary Policy Committee (MPC) forecast that inflation would rise further in coming months, peaking around 7.25% in April. With the Bank of England very much focused on rising prices and already in rate hike mode, clearly the CPI release on Wednesday is going to be a key focus for financial markets.

What to Expect for the January UK CPI Release?

The consensus for the UK January CPI release on Wednesday 16th February is for a 5.4% rise year-on-year according to Bloomberg. The data in December was 5.4%, up from 5.1% in November, with energy costs a significant driver higher. Petrol prices remain at elevated levels as does the oil price, whilst wholesale electricity and gas prices are at extremely high levels.

Source: ONS

Scenario Analysis

A CPI print above the consensus of a 5.4% rise year-on-year would likely see the UK Gilt market (UK Government Bonds) sell off to higher yields, in anticipation of a more hawkish Bank of England, lower real growth and higher long-term interest rates. UK stock indices like the benchmark FTSE 100 would likely sell off, with interest rate sensitive growth stocks likely leading the way, whilst defensive and value stocks would probably outperform (though possibly move lower too).

A CPI print lower than the 5.4% rise year-on-year consensus would likely see UK Gilts rally up, moving to lower yields, due to a likely less hawkish Bank of England, better real growth and lower long-term interest rates. UK stock averages would possibly advance higher, with growth stocks probably leading the rally, whilst defensive and value stocks would probably underperform (though possibly move higher too).

Author: Mr. Steve Miley - Bullseye Financial Senior Investment Consultant

Author: Mr. Steve Miley - Bullseye Financial Senior Investment Consultant