Geopolitical Impacts to Global Commodities Markets – Q1 2022

Effects on Energies, Metals and Agricultural Commodities from the Ukraine-Russia Conflict

Global commodities market certainly endured a spike higher in volatility in Q1 of 2022. Primed with high optimism in growth momentum to start of the year following signs of global economic recoveries. (our article on the commodities market from the start of the year here). But the landscape certainly transformed as the conflict between Ukraine and Russia escalated since Putin first announced Russia’s recognition in the independence of two pro-Russian breakaway regions. Following a full out invasion as Russian forces attempt to push towards Kyiv, the capital of Ukraine, western and other countries responded by imposing limited sanctions on Russia. The Russian Stock Market (RTS Index) fell by up to 39% along with the Russian Ruble plunging to record lows as a result. S&P Global Ratings also downgraded the credit rating of the Russian government to a “junk” rating, causing a massive outflow of investments in Russian debt, which made further borrowing extremely difficult for Russia.

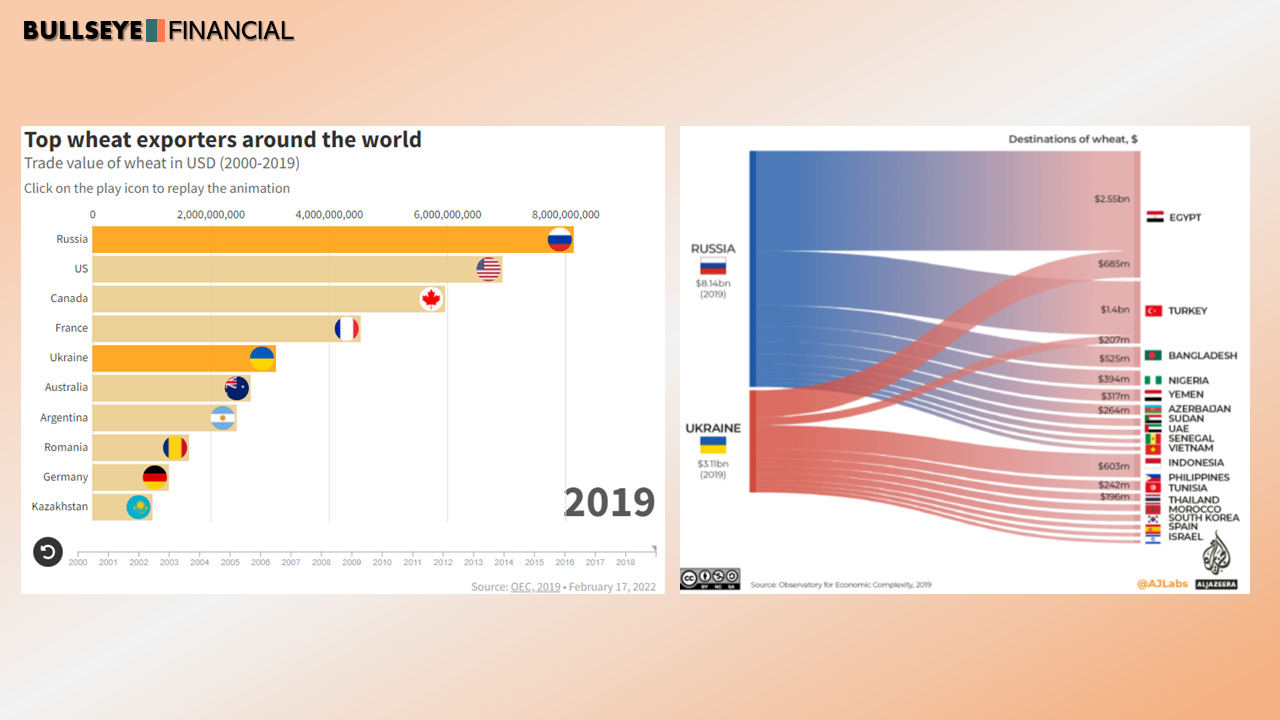

For Russia’s contributions to the global commodities markets, they are the world's 3rd largest oil producer after the United States and Saudi Arabia, with output of 11 million barrels per day. They are also a key producer and exporter of grains and metals. This includes nickel, — a key component in lithium-ion batteries for EV batteries, with Russia being the world’s 3rd largest producer for this industrial metal. Ukraine and Russia are also the world’s largest suppliers of wheat, jointly accounting for nearly 30% of global exports.

Oil

With a barrage of Western sanctions raising concerns of supply disruptions, market rattles at the sign of any impacts to the already delicate global supply chain still recovering from the pandemic. Commodity prices have rallied across the board, with WTI Crude Oil, highly speculated to reclaim triple-digit status at the start of year, to exceed this target with ease and achieved a multi-year high above $128/barrel. From the initial conflict escalation to the continued efforts working towards negotiation for resolution, oil has seen wild price swings, mainly driven by the on-going developments of the conflict. With Open Interest in oil futures dropping to a 7-year low, portfolio managers are cutting their exposures to this termed “untradeable market”, leaving the illiquid market prone to more extreme volatility ahead.

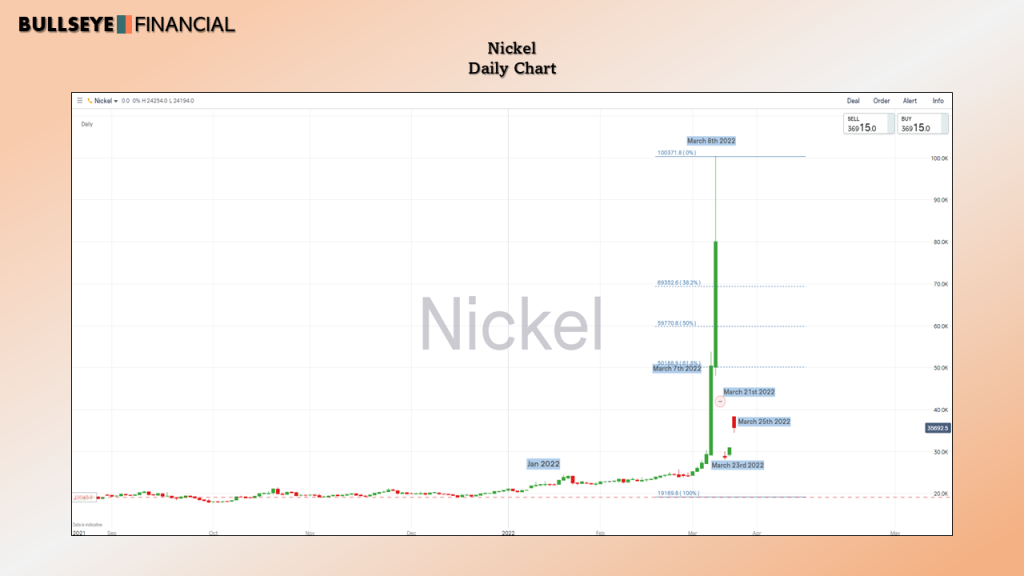

Nickel

Mounting sanctions against Russia sparked surging prices across commodities, but none responded as dramatically as the price of Nickel, plaguing the London Metals Exchange (LME) with trading suspensions and technical glitches. Nickel LME prices soared over 250%, reaching record-high over $101K/ton before plummeting down 70% from the high, but looking to close the quarter 30% higher than the start of March.

Effects on the Nickel price were amplified by a short squeeze in the market as one of the world’s biggest Nickel producers, the Tsingshan Holdings Group, had already built up a significant short position to lock in against the rising prices of Nickel since coming out of the pandemic. Tsingshang Holding Group sustained an estimated $8billion trading loss but assured investors they have since covered their short position and secured a credit lifeline. Analyst believes Tsingshang could still be able to profit from forward contracts given its low production costs. Amid calls for sanction, the LME is still under close consideration and in communication with government officials regarding the banning of Russian metals, responding as their priority to maintain an “orderly market for the benefit of all market participants…”.

Copper

Supply disruptions from sanctions have forced the price of copper, a major industrial metal, to hit an all-time high of $10,910 per tonne, and up 10% since the start of the invasion. Representing only about 4% of total global production of copper, Russia produces around 1 million tonnes per year, with 40% exported to China, who does not have any sanctions imposed against the country. Copper prices have retraced to $10,200 range (at time of print) with some arguing that copper is “mispricing Russian supply risk”. Goldman Sachs remains firm on their view of copper still being in the bullish super-cycle, keeping their elevated target of $12K per tonne over a 12-month time frame.

Wheat

Effects of the war have also pushed into global agriculture instability. Ukraine and Russia are the world’s largest suppliers of wheat, accounting for nearly 30% of global exports, as well as being large consumer markets for food products. Starting 2022 below $8 per bushel, the Chicago Board of Trade (CBOT) Wheat price hit an all-time high of above $13 before finding soft landing just above the $10 mark. As food prices have already been driven up due to global inflation at all-time highs, any further disruption could prove damaging to the already fragile supply chain. This could ultimately erode food security for those countries with strong reliance on Ukraine and Russian imports, with top 3 destinations including Egypt, Turkey, and Bangladesh.

Outlook

Sanctions against Russia have resulted in commodity prices being driven up buyers’ reluctance to commit to Russian supplies, combined with the banks’ unwillingness to finance trades in Russian commodities. This will likely further weigh on Russian’s exports in the global market. Global commodity price speculation shall remain at the whim of the continual developments to the Ukraine-Russia conflict.

Author: Alexander Ng