Explainer: Cash vs Stocks & Shares ISA/JISA

Starting to save for your future is an important step, and there are a number of different ways to do it. Are you considering investing in a Cash or a Stocks and Shares Individual/Junior Individual Savings Account (ISA/JISA)? Here, we're going to compare Cash versus Stocks and Shares ISAs/JISAs as it’s important to understand the key differences between these two types of investments.

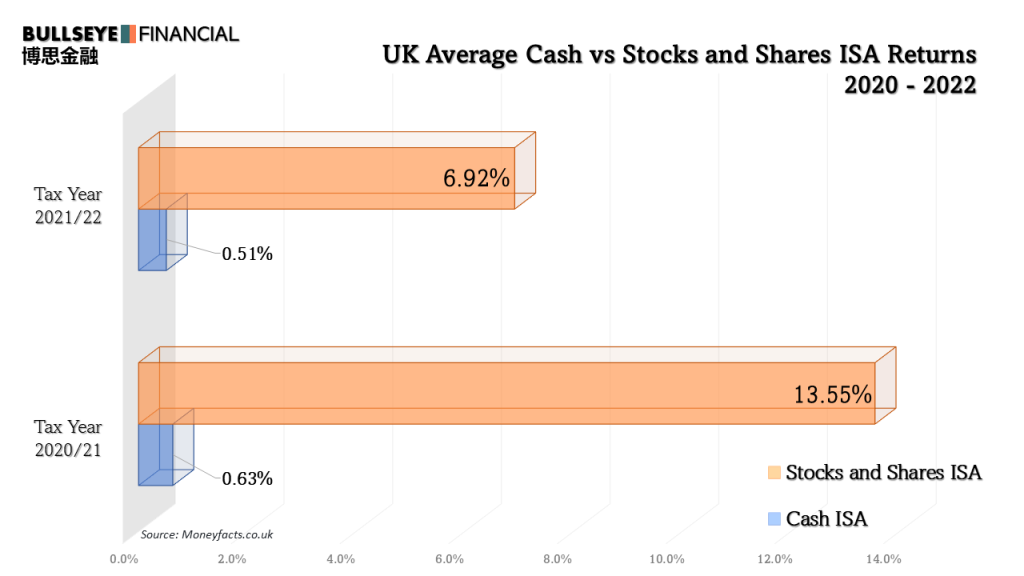

While cash is generally seen as a safe option, stocks and shares can offer the potential for greater returns. Let us outline the pros and cons of each type of investment and the kind of investors best suited to each account type, to help you make an informed decision for your portfolio.

If you're wondering whether a cash or a stocks and shares ISA/ JISA is the right choice for you, keep reading!

Benefits and Drawbacks

Cash ISAs and JISAs are savings accounts where you can save up to £20,000 per tax year (https://www.gov.uk/individual-savings-accounts). The money you save is not subject to tax, so you can earn interest on your savings without having to pay any tax on it. Cash ISAs are easy to open and manage, and you can access your money whenever you need to. However, the interest rates on Cash ISAs are often lower than the interest rates on other types of saving accounts, so your money may not grow as quickly.

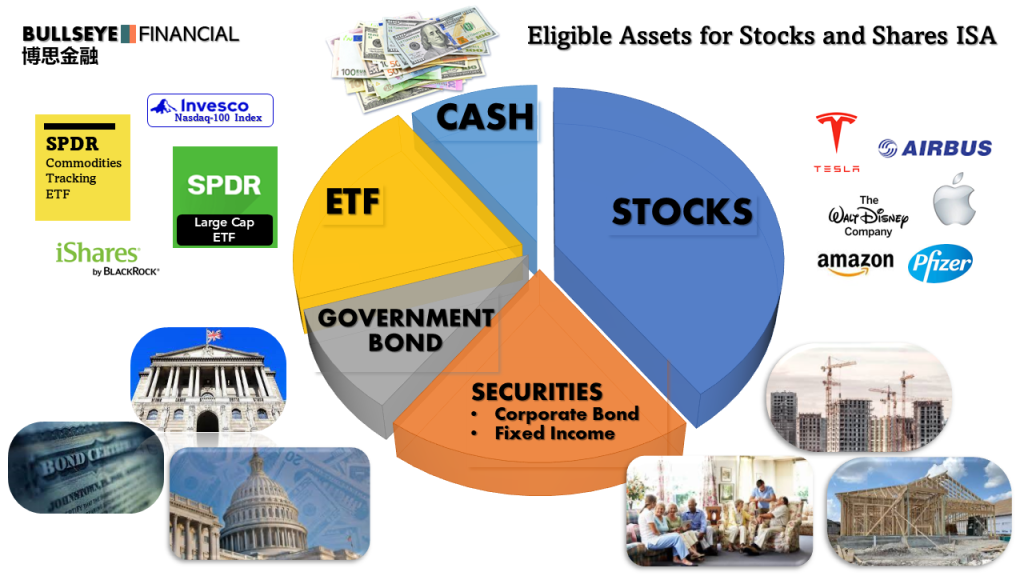

Stocks and Shares ISAs and JISAs are investment accounts where you can invest in a wide range of assets, including shares, bonds, and funds. The value of your investments can go up or down, but you will not have to pay any tax on any profits that you make. Stocks and Shares ISAs can be riskier than Cash ISAs, but they also have the potential to provide higher returns over the long term. You should only invest in a Stocks and Shares ISA if you are willing to take risks with your money and if you understand how the stock market works.

Learn more about BFL Stocks and Shares ISAs and JISAs here

Which option is best for you?

Cash ISAs and JISAs

Cash ISAs and Junior ISAs are investment tools designed specifically for a particular target audience: those who want to save their money in a low-risk, safe vehicle. Cash ISAs and JISAs offer some of the lowest interest rates on the market, but they also help to minimize risk and guarantee that your money will be protected. Additionally, Cash ISA and JISA accounts tend to have relatively low minimum deposit requirements, making them ideal for those looking to start saving. Though Cash ISAs and JISAs offer limited rewards, they remain an important part of any financial portfolio focused on safety and security. So, if you're looking for an option that is low risk yet still allows your money to grow steadily over time, Cash ISA/JISA may be right for you.

Stocks and Shares ISAs and JISAs

Stocks and Shares ISAs/JISAs are investment products that offer the potential for higher returns than cash ISAs/JISAs, but with a higher risk of losses. They are therefore most suited to people who are willing to take on more risk in pursuit of greater rewards. The target audience for Stocks and Shares ISAs/JISAs is, therefore, people who have a medium to high tolerance for risk. This might include investors who are comfortable with the idea of potentially losing some (or even all) of their investment, in exchange for the chance to achieve superior returns.

It is important to note that investments can go down as well as up, and Stocks and Shares ISAs/JISAs are no exception, remember that Stocks and Shares ISAs/JISAs are long-term investment products, and as such, they are not suitable for everyone. Before investing in a Stocks and Shares ISA/JISA, you should carefully consider your tolerance for risk and your financial goals. If you are unsure whether a Stocks and Shares ISA/JISA is right for you, you should seek professional financial advice.

Risk Appetites

As we have covered above, Stocks and Shares ISAs/ JISAs are investment products that offer a higher risk/reward profile than traditional Cash ISAs. They are therefore targeted at investors who are willing to accept a higher degree of risk in exchange for the potential for higher returns. If you have a lower risk appetite, then a Cash ISA/ JISA is likely the better option for you.

| Cash ISA / JISA | Stocks and Shares ISA / JISA | |

| Maximum Investment per Year | £20,000 per Tax Year (£9,000 for JISA) | £20,000 per Tax Year (£9,000 for JISA) |

| Investing In | Cash, a savings account | Shares, bonds, and funds |

| Risk Profile | Lower risk | Higher risk |

| Potential Return Profile | Lower return potential | Higher return potential |

How to invest in Stocks and Shares ISAs/JISAs with Bullseye Financial

If you are considering openning a Stocks and Shares ISA and/or JISAs, our expert investment team at Bullseye Financial can help you take the first step. Get in touch today to discuss future planning options best suitable to help achieve your investment objectives.