Bullseye Financial Global Financial Markets Review – February 2022

As the shortest month of the year, this past February felt incredibly long to investors. Headlines for the month included continual high inflation, expected interest rate hikes, poor earnings outlooks for giants, escalating conflict between Russia and Ukraine, U.S. sanctions against Russia; all dramatically driving up market volatility.

During the month, the three major U.S. stock indices continued their downward spiral - the S&P 500 fell 3.1%, the Dow Jones Industrial Average retreated 3.5% and the Nasdaq sank 3.4%. In Europe, Germany's DAX plummeted 6.8% as a direct result of the invasion into Ukraine by Russia, while the UK's FTSE 100 held firmer, down just 0.1%. Interestingly, over the final few trading days of February, U.S. stocks saw a decent rally led by small and mid-cap growth stocks, perhaps stemming from the fact that these stocks were previously heavily shorted and are now covering their short positions.

Despite the rebound, major indices are still underperforming for 2022. Year-to-date, the S&P 500 is down a cumulative 8.2%, the Dow Jones Industrial Average is down 6.7%, the Nasdaq is down 12.1%, the German DAX is down 9.2%, and only the FTSE 100 is bucking the market by 1%.

When the market is volatile and the direction is unclear, the best way is to place oneself outside the chaos and carefully sort through the causes and directions of each major event. Let's take a closer look individually into major events that happened in February.

Inflation

The U.S. Consumer Price Index (CPI) figure for the month reached 7.5% in January and the core PCE index reached 5.2%, both at their highest levels over the past 40-years. The UK CPI reached 5.5% in January, a record high since 1992. The Bank of England forecasts UK inflation to continue its upward trend, peaking at 7.25% by April. Outlooks for inflation to return to targeted rate of 2% is extended to 2024.

Let's see what factors triggered the high inflation in the United States. The chart below provides detail of January inflation data released by the Bureau of Labor Statistics. As you can see, higher energy and used car prices are key factors in keeping inflation high.

On the energy front, the start of the Russia-Ukraine war had a major impact to the price of oil (Brent Crude), which briefly topped $100 a barrel on the day of the war, a record-high since 2014, though a small pullback soon followed. The EU is heavily dependent on Russia for its energy imports. About 40% of the EU's natural gas imports and 30% of its crude oil imports come directly from Russia, according to a Capital Economics study.

This explains why, at the start of the Russo-Ukrainian war, there were "a lot of thunder but little rain" on the European side, who condemned Russia for their actions while continuing to import Russian oil and gas. For Russia, whose economy is heavily dependent on energy exports, the cost of war will be high, and therefore they’ll be much less likely to lower energy exports but instead aiming to increase their oil production.

Across the ocean, the U.S. has also begun releasing crude oil reserves as a direct response and also is actively in negotiations with Iran to release more of their crude oil reserves in return for easing of sanctions already in place against Iran over their nuclear programme. As long as supplies and demands are able to be met, the impact of the Russia-Ukraine war on energy prices is temporary.

Financial Sanctions

Over the last weekend of February, Russia and Ukraine have had their first round of talks, but no meaningful results were reached. The U.S.-led West has escalated its sanctions against Russia, the most notable of which, known as a "financial nuclear strike," is kicking selected Russian banks out of the SWIFT global settlement system, the code for transferring money between banks worldwide. Without this code, the sanctioned Russian banks can no longer conduct money transfers with the outside world, which can seriously affect Russia's imports and exports as well as the stability of its currency.

The subsequent sanctions, which banned the Central Bank of Russia and national institutions such as the National Wealth Fund from trading in U.S. dollars, added to the woes of Russia's financial system. On February 27, British energy giant BP announced that it would sell its 19.75 percent stake in Rosneft. The White House announcement that removed selected Russian banks out of the SWIFT system did not give the names of the sanctioned banks, but it is reasonable to assume that the banks that were not sanctioned should be those that have business relations with the EU in regards to oil and gas trading settlements.

Global Supply Chain

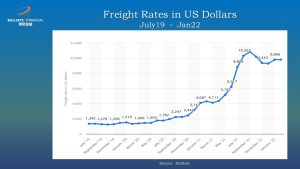

On the supply chain side, supply chain issues are being addressed as countries are phasing out Covid-restrictions in a major push to return to normalcy. According to Statista data per the chart below, global container prices have fallen from their peak since September 2021. This indicator is often viewed as a leading indicator on the overall health of the global supply chain. WTO and Lenovo have also released data indicating that the worst of the supply chain disruption is over. Of course, war may be an impeding factor to the supply chain, as some European countries are already feeling the delays in shipments due to the Russia-Ukraine conflict.

Interest Rate Hike Expectations

The Fed has continued to remain hawkish towards their efforts to control inflation – accelerating tapering, increasing expectations for rate hikes, balance sheet shrinking during the year, and lastly, not ruling out further rate hikes over each coming meeting. Time and time again, the market has accounted for these increasingly aggressive expectations of quantitative tightening. Since the start of February, expectations of a 50 -75 bps rate hike by the end of March were upwards of 95%.

However, this expectation lowered to around 35% by mid-February due to the unstable situation in Russia and Ukraine. As of Feb. 28, the expectation rate has further dropped to 13.3% (chart below). The market believes that whether the Fed raises interest rates or not, and by how much, depends on the further development of the general economy and the control of inflation, and the last thing the Fed wants to see is a systemic risk to the economy, which is what Powell has repeatedly emphasized as "market stability" is the key.

We can also see from the historical data, rate hikes are not the sole driving factor of market volatility, depending on whether the Fed fully communicates with the market, as well as with the appropriate pace to complete the process.

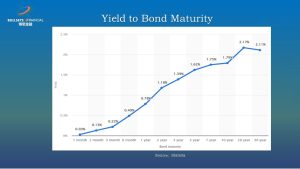

In addition, the Federal Reserve is concerned about changes in the yield curve. The yield curve is a curve that reflects the quantitative relationship between bond yields and their duration. The chart below shows the yield curve for U.S. Treasuries as of January 31, 2022. A healthy yield curve should be upward sloped, which is understandable - longer maturities bring higher uncertainty and therefore require higher yields to compensate. An inverted yield curve (downward sloped) implies a recession or stagnation, something the Fed and any national central bank would never wish to see.

When the Fed (or any country's central bank) wants to control short-term yields, it cuts or increases interest rates, because the central bank's rate hikes and cuts are aimed at the overnight rate, which is the far left of the curve. On the other hand, if they want to control long-term yields, they use quantitative easing / tightening. Quantitative easing is when central banks buy long-term Treasuries to release liquidity into the market. During QE, long-term Treasury bond prices rise and yields fall. Conversely, quantitative tightening is when the central bank stops refinancing the long-term Treasuries on their balance sheet, or, more aggressively, gradually winding down the long-term Treasuries, "draining" the excess liquidity. Long-term Treasury bond prices thus fall and yields rise.

Fed has not yet started to raise interest rates to date, the interest spread (i.e. the slope of the curve) between the 2-year and 10-year U.S. Treasuries has narrowed from 0.9 at the beginning of January to 0.42 on Feb. 28. This interest spread is likely to further narrow down once rate hikes begin. Therefore, the Fed will keep a close eye on the yield curve to avoid "taking too big a step".