Pursue global assets allocation? How to avoid the FX risk?

December 16 2021

| Tags: FX risk, global assets allocation

Friends often ask me: "I live in the U.K. and all my money is the pound Sterling, but I like to invest in US stocks, so I have to change my pounds into U.S. dollars to buy stocks. As a result, there is a FX fee. If the U.S. dollar depreciates against the pound when I sell the stocks, will my investment be worthless?"

Indeed, guided by the concept of global assets allocation, investors can now invest in multiple markets around the world, during which the foreign exchange risk is inevitable. How should we control or avoid the risk of exchange rate?

First of all, I need to correct an idea. The view that "you have to sell pound for U.S. dollars" to invest in U.S. stocks is not entirely correct. Actually, it is fine to convert cash into a foreign currency through a bank or currency exchange agency and then invest through securities traders. But, this series of operations is not really necessary, because many securities traders now offer customers two options when customers open an account - cash account and margin account. A cash account refers to an account in which you buy assets in the currency you deposit. A margin account means you may borrow foreign currencies directly from a securities trader by using cash deposited at the securities trader and stocks purchased later as collaterals.

It sounds a little complicated, right? The practical operation is very simple. When you open a margin account with a securities trader, you may deposit cash, such as pound. Then, when you buy non-pound stocks such as European or U.S. stocks, the securities trader automatically calculates the exchange rate and lends you euros or U.S. dollars. When you sell these shares, the securities trader will automatically return the pound to you based on the exchange rate. Certainly, financing is not free. Let's take IBKR for example. According to the different loan amounts, IBKR charges a certain amount of interest (see the figure below), which is added on the basis of the benchmark interest rate, calculated daily and settled monthly.

When hearing margin account, some friends may be involuntarily nervous and ask, "Is there a risk of margin closeout?" In fact, as long as you're not overleveraged and only borrow different currencies to buy stocks, the risk of margin closeout is very low.

If opening a margin account with a securities trader is not your option, how can you avoid the exchange rate risk? A simple but effective way is to buy reverse currency ETF. For example, if you convert GBP 1 million into U.S. dollars to invest in U.S. stocks, the risk you should avoid is a fall in the U.S. dollar. To hedge against this risk, you may buy the ETF that is long for pound and short for the dollar. If U.S. dollar falls, your stock returns will shrink, but the reverse ETF will bring you gains, which hedges against the risks of changes in the exchange rate.

Of course, such investment strategy is not perfect, and its problems include: 1) some funds need to be used to hedge against the exchange rate risk and cannot be used for investment, which may lead to a lower rate of return; 2) generally, only international mainstream currencies, such as Japanese Yen, Euro and U.S. dollar, have such ETFs; 3) besides, ETFs also have administrative fees.

In addition to buying reverse ETF, you may also consider currency CFD, futures and forward contracts. These tools do not require a lot of capital, and the cost is low. But they are not suitable for individual investors, because they require a large amount of capital, and one futures contract is equal to 100 shares. Thus, hundreds of thousands and even over one million are generally required. We will not introduce it in detail.

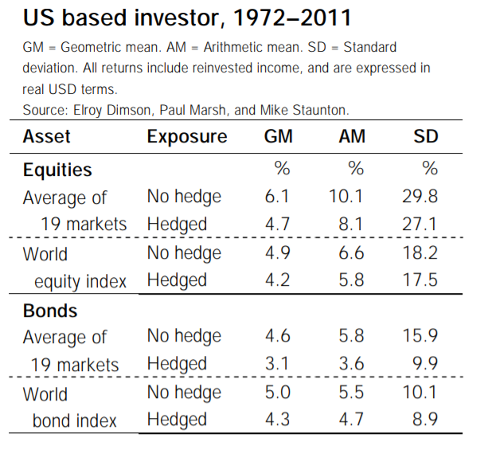

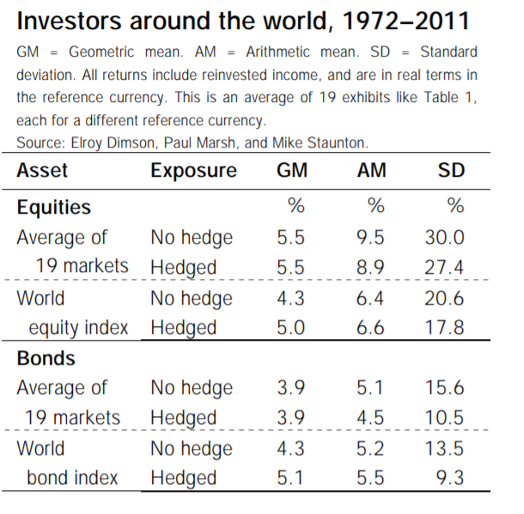

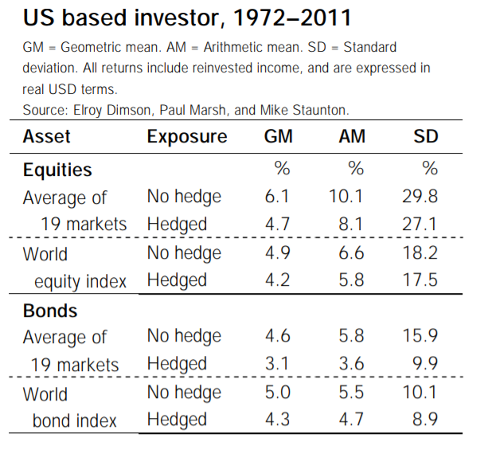

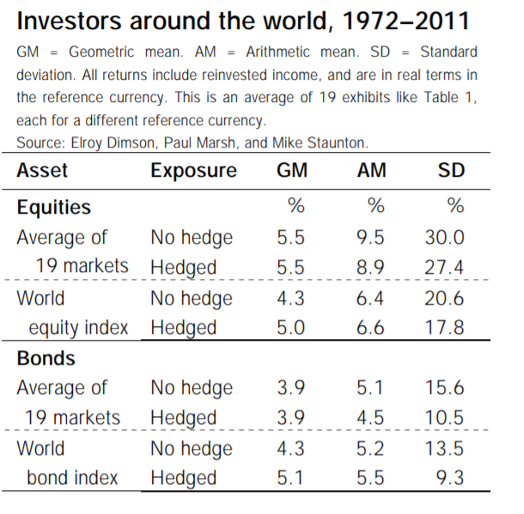

In the end, if you are a long-term investor, you may be surprised to hear that avoiding the FX risk actually does not affect the long-term investment result. In a study, Credit Suisse analyzed 40 years of data from 1972 to 2011, finding that the rates of return on U.S. and global stock and bond investments were about the same with or without hedging the FX risk. In many cases, the rate of return is even higher without the hedge, because it avoids capital occupying and expenses.

When hearing margin account, some friends may be involuntarily nervous and ask, "Is there a risk of margin closeout?" In fact, as long as you're not overleveraged and only borrow different currencies to buy stocks, the risk of margin closeout is very low.

If opening a margin account with a securities trader is not your option, how can you avoid the exchange rate risk? A simple but effective way is to buy reverse currency ETF. For example, if you convert GBP 1 million into U.S. dollars to invest in U.S. stocks, the risk you should avoid is a fall in the U.S. dollar. To hedge against this risk, you may buy the ETF that is long for pound and short for the dollar. If U.S. dollar falls, your stock returns will shrink, but the reverse ETF will bring you gains, which hedges against the risks of changes in the exchange rate.

Of course, such investment strategy is not perfect, and its problems include: 1) some funds need to be used to hedge against the exchange rate risk and cannot be used for investment, which may lead to a lower rate of return; 2) generally, only international mainstream currencies, such as Japanese Yen, Euro and U.S. dollar, have such ETFs; 3) besides, ETFs also have administrative fees.

In addition to buying reverse ETF, you may also consider currency CFD, futures and forward contracts. These tools do not require a lot of capital, and the cost is low. But they are not suitable for individual investors, because they require a large amount of capital, and one futures contract is equal to 100 shares. Thus, hundreds of thousands and even over one million are generally required. We will not introduce it in detail.

In the end, if you are a long-term investor, you may be surprised to hear that avoiding the FX risk actually does not affect the long-term investment result. In a study, Credit Suisse analyzed 40 years of data from 1972 to 2011, finding that the rates of return on U.S. and global stock and bond investments were about the same with or without hedging the FX risk. In many cases, the rate of return is even higher without the hedge, because it avoids capital occupying and expenses.

This results is called the mean reversion effect of exchange rates. In short, as long as the country is politically and economically stable, its exchange rate may fluctuate in a short term, but in the long run, it will generally return to a stable range. Hence, we consider that as long as the currencies held are the currencies of mainstream developed economies (such as U.S. Dollar, British Pound, Japanese Yen, and Australian Dollar), the exchange rate risk is low, and long-term investors may ignore short-term exchange rate fluctuations.

This results is called the mean reversion effect of exchange rates. In short, as long as the country is politically and economically stable, its exchange rate may fluctuate in a short term, but in the long run, it will generally return to a stable range. Hence, we consider that as long as the currencies held are the currencies of mainstream developed economies (such as U.S. Dollar, British Pound, Japanese Yen, and Australian Dollar), the exchange rate risk is low, and long-term investors may ignore short-term exchange rate fluctuations.

Author: Dr.Wei Shi (CIO of Bullseye Financial Ltd, CFA)

Author: Dr.Wei Shi (CIO of Bullseye Financial Ltd, CFA)

When hearing margin account, some friends may be involuntarily nervous and ask, "Is there a risk of margin closeout?" In fact, as long as you're not overleveraged and only borrow different currencies to buy stocks, the risk of margin closeout is very low.

If opening a margin account with a securities trader is not your option, how can you avoid the exchange rate risk? A simple but effective way is to buy reverse currency ETF. For example, if you convert GBP 1 million into U.S. dollars to invest in U.S. stocks, the risk you should avoid is a fall in the U.S. dollar. To hedge against this risk, you may buy the ETF that is long for pound and short for the dollar. If U.S. dollar falls, your stock returns will shrink, but the reverse ETF will bring you gains, which hedges against the risks of changes in the exchange rate.

Of course, such investment strategy is not perfect, and its problems include: 1) some funds need to be used to hedge against the exchange rate risk and cannot be used for investment, which may lead to a lower rate of return; 2) generally, only international mainstream currencies, such as Japanese Yen, Euro and U.S. dollar, have such ETFs; 3) besides, ETFs also have administrative fees.

In addition to buying reverse ETF, you may also consider currency CFD, futures and forward contracts. These tools do not require a lot of capital, and the cost is low. But they are not suitable for individual investors, because they require a large amount of capital, and one futures contract is equal to 100 shares. Thus, hundreds of thousands and even over one million are generally required. We will not introduce it in detail.

In the end, if you are a long-term investor, you may be surprised to hear that avoiding the FX risk actually does not affect the long-term investment result. In a study, Credit Suisse analyzed 40 years of data from 1972 to 2011, finding that the rates of return on U.S. and global stock and bond investments were about the same with or without hedging the FX risk. In many cases, the rate of return is even higher without the hedge, because it avoids capital occupying and expenses.

When hearing margin account, some friends may be involuntarily nervous and ask, "Is there a risk of margin closeout?" In fact, as long as you're not overleveraged and only borrow different currencies to buy stocks, the risk of margin closeout is very low.

If opening a margin account with a securities trader is not your option, how can you avoid the exchange rate risk? A simple but effective way is to buy reverse currency ETF. For example, if you convert GBP 1 million into U.S. dollars to invest in U.S. stocks, the risk you should avoid is a fall in the U.S. dollar. To hedge against this risk, you may buy the ETF that is long for pound and short for the dollar. If U.S. dollar falls, your stock returns will shrink, but the reverse ETF will bring you gains, which hedges against the risks of changes in the exchange rate.

Of course, such investment strategy is not perfect, and its problems include: 1) some funds need to be used to hedge against the exchange rate risk and cannot be used for investment, which may lead to a lower rate of return; 2) generally, only international mainstream currencies, such as Japanese Yen, Euro and U.S. dollar, have such ETFs; 3) besides, ETFs also have administrative fees.

In addition to buying reverse ETF, you may also consider currency CFD, futures and forward contracts. These tools do not require a lot of capital, and the cost is low. But they are not suitable for individual investors, because they require a large amount of capital, and one futures contract is equal to 100 shares. Thus, hundreds of thousands and even over one million are generally required. We will not introduce it in detail.

In the end, if you are a long-term investor, you may be surprised to hear that avoiding the FX risk actually does not affect the long-term investment result. In a study, Credit Suisse analyzed 40 years of data from 1972 to 2011, finding that the rates of return on U.S. and global stock and bond investments were about the same with or without hedging the FX risk. In many cases, the rate of return is even higher without the hedge, because it avoids capital occupying and expenses.

This results is called the mean reversion effect of exchange rates. In short, as long as the country is politically and economically stable, its exchange rate may fluctuate in a short term, but in the long run, it will generally return to a stable range. Hence, we consider that as long as the currencies held are the currencies of mainstream developed economies (such as U.S. Dollar, British Pound, Japanese Yen, and Australian Dollar), the exchange rate risk is low, and long-term investors may ignore short-term exchange rate fluctuations.

This results is called the mean reversion effect of exchange rates. In short, as long as the country is politically and economically stable, its exchange rate may fluctuate in a short term, but in the long run, it will generally return to a stable range. Hence, we consider that as long as the currencies held are the currencies of mainstream developed economies (such as U.S. Dollar, British Pound, Japanese Yen, and Australian Dollar), the exchange rate risk is low, and long-term investors may ignore short-term exchange rate fluctuations.

Author: Dr.Wei Shi (CIO of Bullseye Financial Ltd, CFA)

Author: Dr.Wei Shi (CIO of Bullseye Financial Ltd, CFA)