[Investment 101] How to Invest If A Beginner Wants to Enter the Cryptocurrency Track?

December 14 2021

| Tags: Cryptocurrency, Investment 101

Fund or ETF? CEX or DEX? How to choose a broker? If you are really interested in cryptocurrency after adequate risk assessment and position sizing, for so many ways to invest, what are their advantages and disadvantages? This article will discuss this area.

Cryptocurrencies, especially Bitcoin and Ether, have been more and more accepted by mainstream investment institutions. For example, Ray Dario, founder of the famous Bridgewater Associates, publicly said that Bridgewater portfolio has converted some of its gold positions into Bitcoin. However, we still want remind investors that the operation mechanism behind cryptocurrencies is a new and complicated concept and is of high volatility. Therefore, it is important to weigh up the risks and invest cautiously.

If you decide to invest in cryptocurrency after adequate risk assessment and position sizing, what are the options, and what are their advantages and disadvantages?

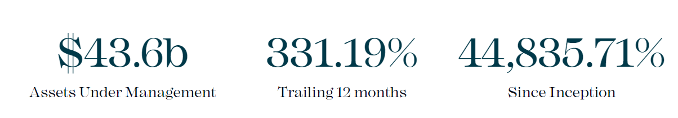

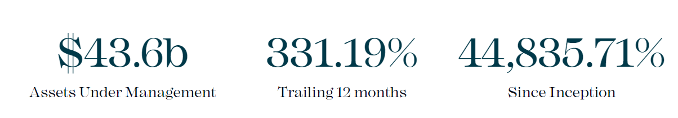

The first is the simplest, that is, to buy cryptocurrency-related products directly from your stock account. The oldest Bitcoin trust fund on the market is Grayscale Bitcoin Trust (stock code GBTC). Its greatest advantage is that it holds all Bitcoins in stock and it is the biggest spot Bitcoin holder in the world. Its AUM is USD 43.6 billion, up 331.19% over the past 12 months, showing the market's enthusiasm for investing in Bitcoin.

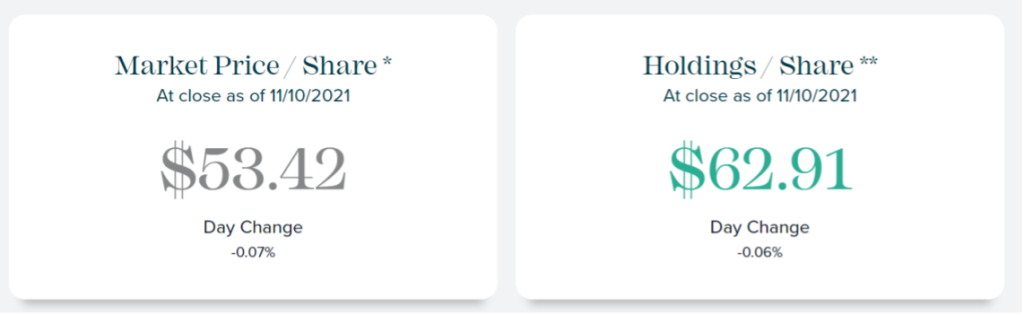

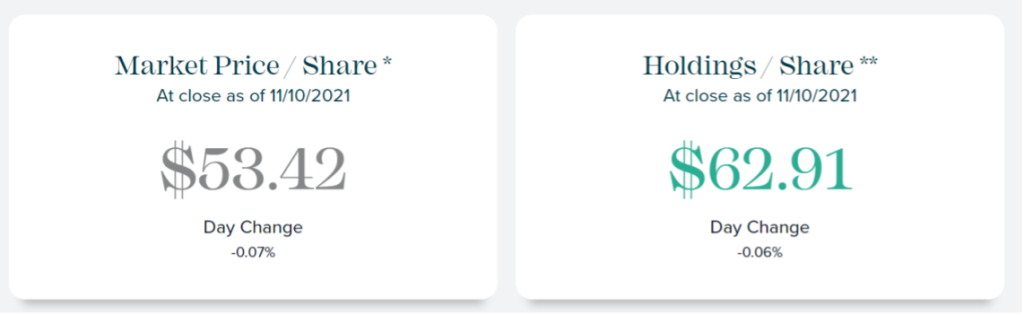

Interestingly, its current net asset value (USD 62.91 per share) is significantly higher than its market price (USD 53.42 per share), which means that if you buy the stocks of GBTC now, you are buying Bitcoin at a price about 20% lower than the market price.

Interestingly, its current net asset value (USD 62.91 per share) is significantly higher than its market price (USD 53.42 per share), which means that if you buy the stocks of GBTC now, you are buying Bitcoin at a price about 20% lower than the market price.

This is where you need to be careful when investing in trust fund — market prices and net asset values can vary depending on market sentiment, and these variances can't always be filled in. Therefore, it is inadvisable to buy just because the net asset value is higher than market price. Recently, Grayscale Trust applied to SEC to convert its products into ETF, which is pending approval. If successful, the introduction of the excellent operation mechanism of ETF, i.e. the intervention of "Authorised Participants", will improve the great variance between net asset value and market price. (We have explained the operation mechanisms of AP and ETF in detail in our previous article. You can read the article by clicking the link at the bottom of the video if you are interested.)

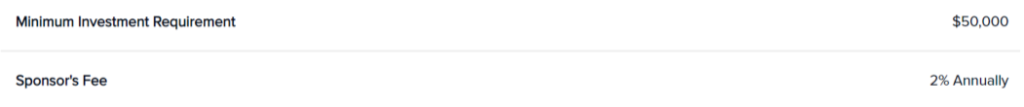

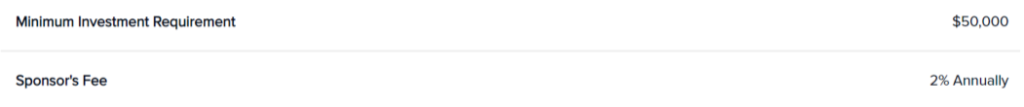

Moreover, Grayscale Trust has the minimum investment requirement of USD 50,000, bringing about certain barriers to entry. A 2% annual management fee is high compared with other ETFs.

This is where you need to be careful when investing in trust fund — market prices and net asset values can vary depending on market sentiment, and these variances can't always be filled in. Therefore, it is inadvisable to buy just because the net asset value is higher than market price. Recently, Grayscale Trust applied to SEC to convert its products into ETF, which is pending approval. If successful, the introduction of the excellent operation mechanism of ETF, i.e. the intervention of "Authorised Participants", will improve the great variance between net asset value and market price. (We have explained the operation mechanisms of AP and ETF in detail in our previous article. You can read the article by clicking the link at the bottom of the video if you are interested.)

Moreover, Grayscale Trust has the minimum investment requirement of USD 50,000, bringing about certain barriers to entry. A 2% annual management fee is high compared with other ETFs.

Secondly, let's look at the Bitcoin futures ETFs recently approved by SEC — ProShares Bitcoin Strategy ETF (stock code BITO) and Valkyrie Bitcoin Strategy ETF (stock code BTF). As ETFs, their biggest advantage is that the real-time price of Bitcoin can be simulated with almost no price difference, unlike the previous Grayscale Trust, which cannot be tracked perfectly due to the difference between net asset value and market price. However, their defect is also obvious: they are futures ETFs. Like all futures ETFs, they suffer from a Contango problem, that is, transfer losses. A straightforward explanation is that, these two ETFs hold Bitcoin option contracts rather than cash. However, contracts have an expiration date and need to roll over, that is, to sell contracts that expire in the near future and buy forward contracts. When forward contract price is higher than nearby contract price, ETFs can but sell at a low price and buy at a high price, which causes losses.

The management fee of both ETFs is 0.95%.

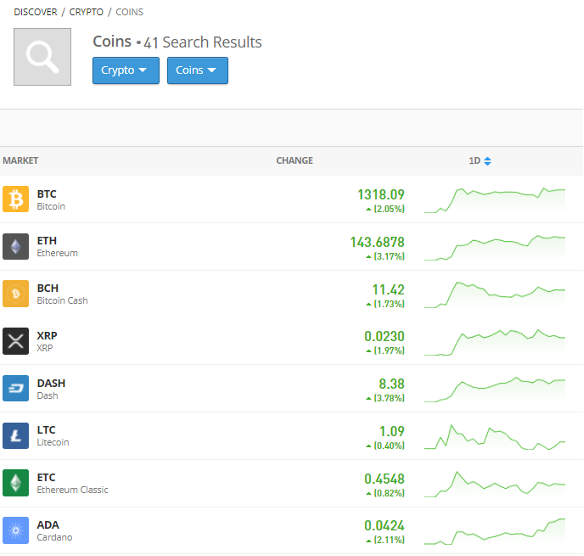

Besides buying directly from your stock account, the second way to invest in cryptocurrency is to buy directly from exchanges. Exchanges includes centralized exchanges (CEX) and decentralized exchanges (DEX). CEX, including Coinbase, Etoro and Robinhood we know, allows for simple trading of cryptocurrencies.

Secondly, let's look at the Bitcoin futures ETFs recently approved by SEC — ProShares Bitcoin Strategy ETF (stock code BITO) and Valkyrie Bitcoin Strategy ETF (stock code BTF). As ETFs, their biggest advantage is that the real-time price of Bitcoin can be simulated with almost no price difference, unlike the previous Grayscale Trust, which cannot be tracked perfectly due to the difference between net asset value and market price. However, their defect is also obvious: they are futures ETFs. Like all futures ETFs, they suffer from a Contango problem, that is, transfer losses. A straightforward explanation is that, these two ETFs hold Bitcoin option contracts rather than cash. However, contracts have an expiration date and need to roll over, that is, to sell contracts that expire in the near future and buy forward contracts. When forward contract price is higher than nearby contract price, ETFs can but sell at a low price and buy at a high price, which causes losses.

The management fee of both ETFs is 0.95%.

Besides buying directly from your stock account, the second way to invest in cryptocurrency is to buy directly from exchanges. Exchanges includes centralized exchanges (CEX) and decentralized exchanges (DEX). CEX, including Coinbase, Etoro and Robinhood we know, allows for simple trading of cryptocurrencies.

However, it should be mentioned here that there is a difference between Coinbase and such stock brokers as Etoro and Robinhood. Because all cryptocurrency transactions in brokers are paper transactions, some cryptocurrency-specific features that generate extra yields, such as cryptocurrency pledge and liquidity mining, are not available. Moreover, only paper transactions are involved, and brokers themselves do not hold these cryptocurrencies, so it is impossible to complete broker to broker asset transfer. However, the great thing about it is easy to operate and not requiring a separate account.

Pure cryptocurrency CEXs like Coinbase, which holds cryptocurrencies itself, support the above mentioned features such as pledge and mining. However, the problem is, in some areas, there may be restrictions on opening an account for regulatory reasons; in other areas, there may be restrictions on the amount of money bought in a single day.

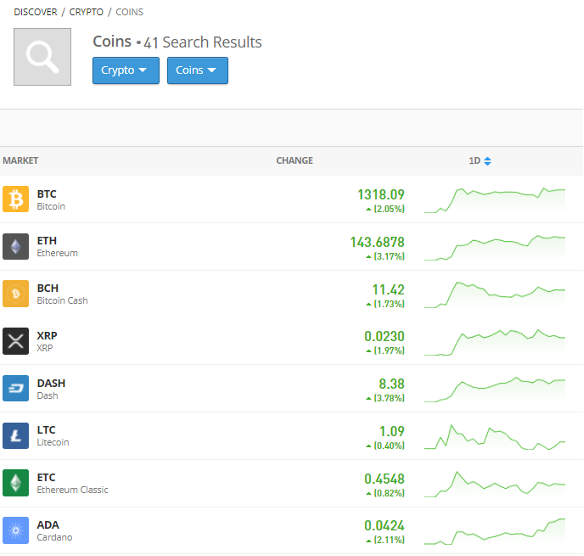

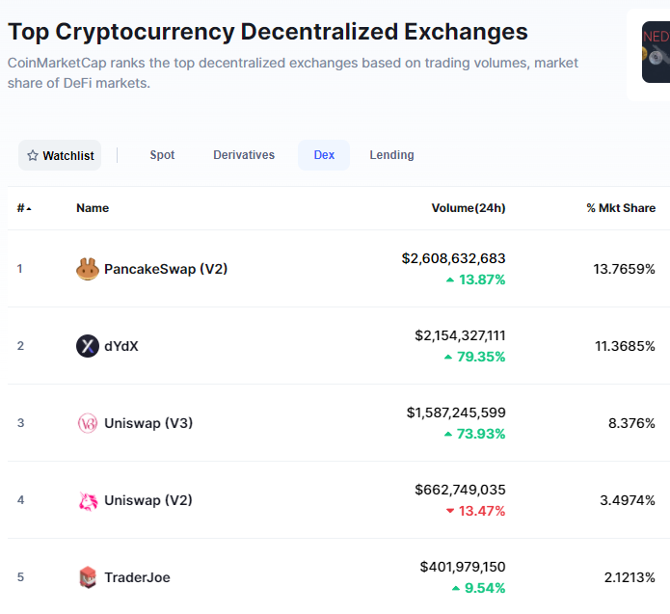

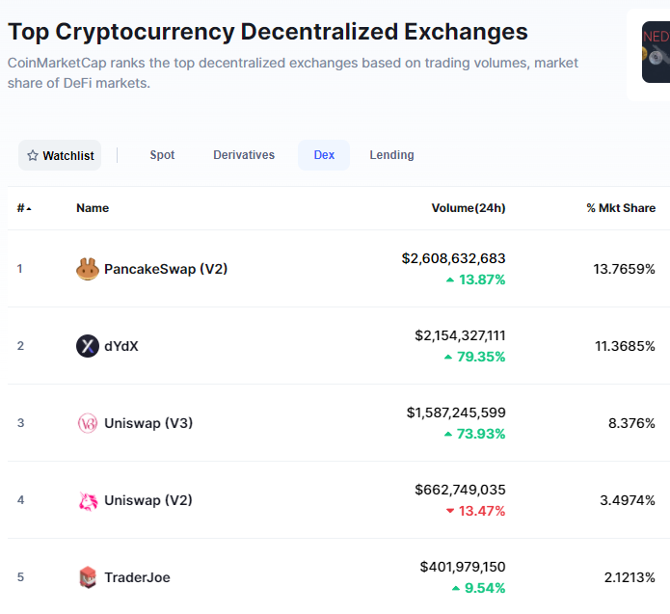

The biggest strength of DEXs, such as PancakeSwap and Uniswap, is the abundance of programs. Many programs that are not available in CEX can also be found here. There are thousands of different cryptocurrencies on the market, but only a few hundred can be traded on Coinbase. That's because an exchange as big as Coinbase has its own review process before launching a new coin.

However, it should be mentioned here that there is a difference between Coinbase and such stock brokers as Etoro and Robinhood. Because all cryptocurrency transactions in brokers are paper transactions, some cryptocurrency-specific features that generate extra yields, such as cryptocurrency pledge and liquidity mining, are not available. Moreover, only paper transactions are involved, and brokers themselves do not hold these cryptocurrencies, so it is impossible to complete broker to broker asset transfer. However, the great thing about it is easy to operate and not requiring a separate account.

Pure cryptocurrency CEXs like Coinbase, which holds cryptocurrencies itself, support the above mentioned features such as pledge and mining. However, the problem is, in some areas, there may be restrictions on opening an account for regulatory reasons; in other areas, there may be restrictions on the amount of money bought in a single day.

The biggest strength of DEXs, such as PancakeSwap and Uniswap, is the abundance of programs. Many programs that are not available in CEX can also be found here. There are thousands of different cryptocurrencies on the market, but only a few hundred can be traded on Coinbase. That's because an exchange as big as Coinbase has its own review process before launching a new coin.

Author: Dr.Wei Shi (CIO of Bullseye Financial Ltd, CFA)

Author: Dr.Wei Shi (CIO of Bullseye Financial Ltd, CFA)

Interestingly, its current net asset value (USD 62.91 per share) is significantly higher than its market price (USD 53.42 per share), which means that if you buy the stocks of GBTC now, you are buying Bitcoin at a price about 20% lower than the market price.

Interestingly, its current net asset value (USD 62.91 per share) is significantly higher than its market price (USD 53.42 per share), which means that if you buy the stocks of GBTC now, you are buying Bitcoin at a price about 20% lower than the market price.

This is where you need to be careful when investing in trust fund — market prices and net asset values can vary depending on market sentiment, and these variances can't always be filled in. Therefore, it is inadvisable to buy just because the net asset value is higher than market price. Recently, Grayscale Trust applied to SEC to convert its products into ETF, which is pending approval. If successful, the introduction of the excellent operation mechanism of ETF, i.e. the intervention of "Authorised Participants", will improve the great variance between net asset value and market price. (We have explained the operation mechanisms of AP and ETF in detail in our previous article. You can read the article by clicking the link at the bottom of the video if you are interested.)

Moreover, Grayscale Trust has the minimum investment requirement of USD 50,000, bringing about certain barriers to entry. A 2% annual management fee is high compared with other ETFs.

This is where you need to be careful when investing in trust fund — market prices and net asset values can vary depending on market sentiment, and these variances can't always be filled in. Therefore, it is inadvisable to buy just because the net asset value is higher than market price. Recently, Grayscale Trust applied to SEC to convert its products into ETF, which is pending approval. If successful, the introduction of the excellent operation mechanism of ETF, i.e. the intervention of "Authorised Participants", will improve the great variance between net asset value and market price. (We have explained the operation mechanisms of AP and ETF in detail in our previous article. You can read the article by clicking the link at the bottom of the video if you are interested.)

Moreover, Grayscale Trust has the minimum investment requirement of USD 50,000, bringing about certain barriers to entry. A 2% annual management fee is high compared with other ETFs.

Secondly, let's look at the Bitcoin futures ETFs recently approved by SEC — ProShares Bitcoin Strategy ETF (stock code BITO) and Valkyrie Bitcoin Strategy ETF (stock code BTF). As ETFs, their biggest advantage is that the real-time price of Bitcoin can be simulated with almost no price difference, unlike the previous Grayscale Trust, which cannot be tracked perfectly due to the difference between net asset value and market price. However, their defect is also obvious: they are futures ETFs. Like all futures ETFs, they suffer from a Contango problem, that is, transfer losses. A straightforward explanation is that, these two ETFs hold Bitcoin option contracts rather than cash. However, contracts have an expiration date and need to roll over, that is, to sell contracts that expire in the near future and buy forward contracts. When forward contract price is higher than nearby contract price, ETFs can but sell at a low price and buy at a high price, which causes losses.

The management fee of both ETFs is 0.95%.

Besides buying directly from your stock account, the second way to invest in cryptocurrency is to buy directly from exchanges. Exchanges includes centralized exchanges (CEX) and decentralized exchanges (DEX). CEX, including Coinbase, Etoro and Robinhood we know, allows for simple trading of cryptocurrencies.

Secondly, let's look at the Bitcoin futures ETFs recently approved by SEC — ProShares Bitcoin Strategy ETF (stock code BITO) and Valkyrie Bitcoin Strategy ETF (stock code BTF). As ETFs, their biggest advantage is that the real-time price of Bitcoin can be simulated with almost no price difference, unlike the previous Grayscale Trust, which cannot be tracked perfectly due to the difference between net asset value and market price. However, their defect is also obvious: they are futures ETFs. Like all futures ETFs, they suffer from a Contango problem, that is, transfer losses. A straightforward explanation is that, these two ETFs hold Bitcoin option contracts rather than cash. However, contracts have an expiration date and need to roll over, that is, to sell contracts that expire in the near future and buy forward contracts. When forward contract price is higher than nearby contract price, ETFs can but sell at a low price and buy at a high price, which causes losses.

The management fee of both ETFs is 0.95%.

Besides buying directly from your stock account, the second way to invest in cryptocurrency is to buy directly from exchanges. Exchanges includes centralized exchanges (CEX) and decentralized exchanges (DEX). CEX, including Coinbase, Etoro and Robinhood we know, allows for simple trading of cryptocurrencies.

However, it should be mentioned here that there is a difference between Coinbase and such stock brokers as Etoro and Robinhood. Because all cryptocurrency transactions in brokers are paper transactions, some cryptocurrency-specific features that generate extra yields, such as cryptocurrency pledge and liquidity mining, are not available. Moreover, only paper transactions are involved, and brokers themselves do not hold these cryptocurrencies, so it is impossible to complete broker to broker asset transfer. However, the great thing about it is easy to operate and not requiring a separate account.

Pure cryptocurrency CEXs like Coinbase, which holds cryptocurrencies itself, support the above mentioned features such as pledge and mining. However, the problem is, in some areas, there may be restrictions on opening an account for regulatory reasons; in other areas, there may be restrictions on the amount of money bought in a single day.

The biggest strength of DEXs, such as PancakeSwap and Uniswap, is the abundance of programs. Many programs that are not available in CEX can also be found here. There are thousands of different cryptocurrencies on the market, but only a few hundred can be traded on Coinbase. That's because an exchange as big as Coinbase has its own review process before launching a new coin.

However, it should be mentioned here that there is a difference between Coinbase and such stock brokers as Etoro and Robinhood. Because all cryptocurrency transactions in brokers are paper transactions, some cryptocurrency-specific features that generate extra yields, such as cryptocurrency pledge and liquidity mining, are not available. Moreover, only paper transactions are involved, and brokers themselves do not hold these cryptocurrencies, so it is impossible to complete broker to broker asset transfer. However, the great thing about it is easy to operate and not requiring a separate account.

Pure cryptocurrency CEXs like Coinbase, which holds cryptocurrencies itself, support the above mentioned features such as pledge and mining. However, the problem is, in some areas, there may be restrictions on opening an account for regulatory reasons; in other areas, there may be restrictions on the amount of money bought in a single day.

The biggest strength of DEXs, such as PancakeSwap and Uniswap, is the abundance of programs. Many programs that are not available in CEX can also be found here. There are thousands of different cryptocurrencies on the market, but only a few hundred can be traded on Coinbase. That's because an exchange as big as Coinbase has its own review process before launching a new coin.

Author: Dr.Wei Shi (CIO of Bullseye Financial Ltd, CFA)

Author: Dr.Wei Shi (CIO of Bullseye Financial Ltd, CFA)