Focus: Cash vs Stocks & Shares ISA/JISA

Having looked at the relative merits of a Cash or a Stocks and Shares ISA or JISA in our Explainer article, we are now going to take a more focussed look at the relative performance of having held cash in an ISA against having invested in a Stocks and Shares ISA over time. We hope this will Fuhrer assist on you in making a knowledgeable choice for your investment portfolio.

The Historic Performance of Cash vs Stocks and Shares ISAs

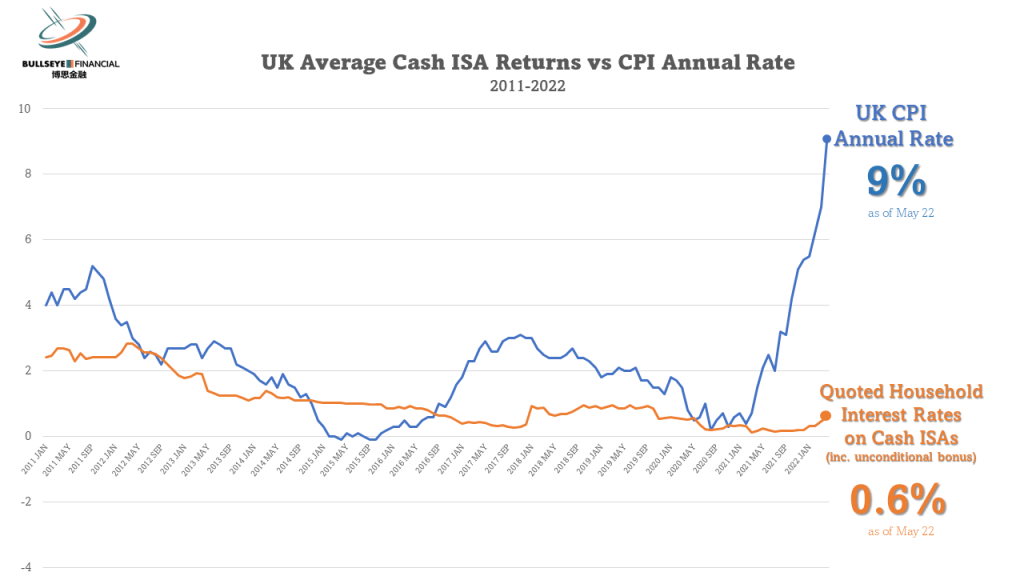

Cash ISAs can be attractive as there is apparently no risk to your investment. You will get the full amount you have invested returned, plus whatever interest rate you receive. However, interest rates have been extremely low throughout the 21st century and particularly since the Global Financial Crisis of 2008/2009 and through the COVID-19 pandemic of 2020-2022. Even though average Cash ISA rates have begun to climb in 2022 as global central banks and in particular the Bank of England have increased interest rates, these extra returns come at a cost!

Over the past 10 years, the average Cash ISA rates have been below the rate of inflation (Source: Bank of England), which means that the true value of your investment has actually been falling. More worrying than this, is that in 2022, global and UK inflation has spiked higher. In the UK the Consumer Price Index (CPI) inflation rate for April 2022 (Source: ONS) was 9%, its highest level for over 30 years. This compares with an average Cash ISA rate of only 0.60% at the end of April 2022.

Advantages and Disadvantages of Cash vs Stocks and Shares ISAs

There are advantages and disadvantages to opening a Cash ISA.

- A Cash ISA is simple to open and manage

- You can access your money whenever you need to

- But the interest rates on Cash ISAs are often lower than the interest rates on other types of saving accounts

- And as we show above, high inflation rates means that the real value of your investment is possibly (and likely in the current environment) falling in value

There are advantages and disadvantages to opening a Stocks and Shares ISAs.

There are advantages and disadvantages to opening a Stocks and Shares ISAs.

- You can invest in a wide range of assets, including shares, bonds, and funds

- The value of your investments can go up or down

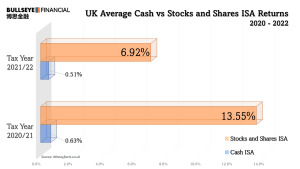

- Stocks and Shares ISAs can be riskier than Cash ISAs, but they also have the potential to provide higher returns over the long term